Differences in the MYOB and Xero chart of accounts

Here are a number of observations around the differences in the way MYOB and Xero chart of accounts work. This is useful to understand if you are assessing which system you would like to work with.

Account Numbers

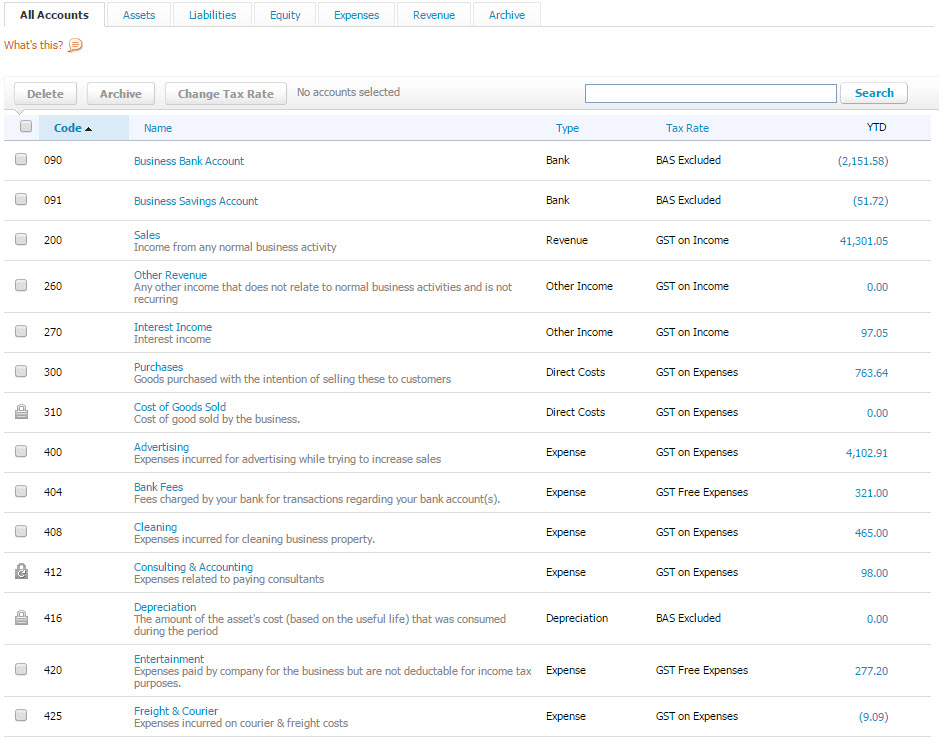

Xero account numbers are completely wild and free – they can be numbers, decimals or letters, and there is no restriction over what has to be assigned to an asset, or liability.

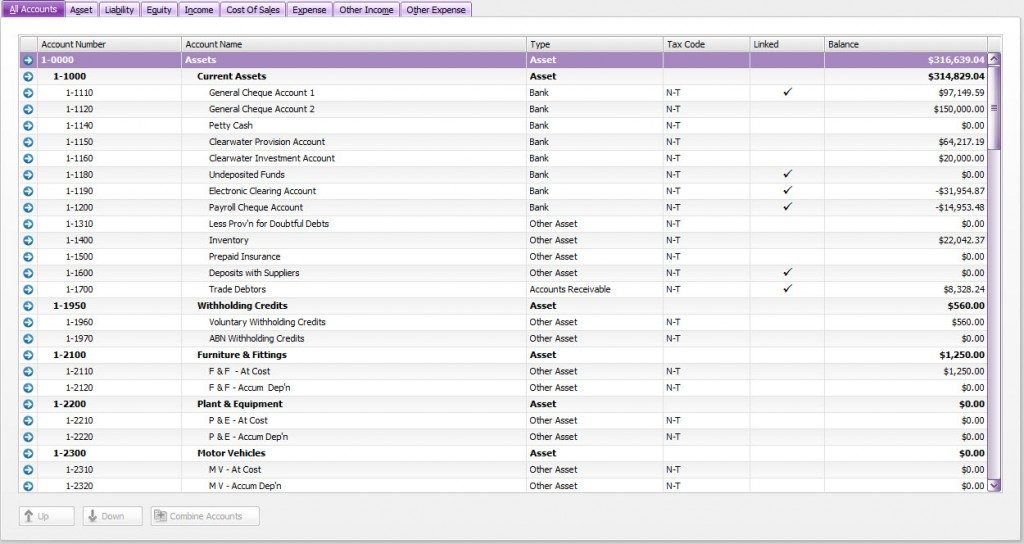

The MYOB account numbers are regimented. They are all 5 digits long, and assets start with a 1, liabilities start with a 2, and so on.

I understand you can have up to 10 000 general ledger lines in MYOB (but that would be impossible to manage). In Xero the limit is 700, which is more than enough for any business I’ve ever dealt with.

You can continue to use the existing MYOB numbers, or you can change them before or once they are in Xero.

In MYOB the account number order determined the order the accounts would appear on the financial statement. In Xero, the actual account number is irrelevant to the ordering of the financial statements, what is relevant to the order is the account type. You may use the account number to map the accounts, to other partner solutions, or to comparative reporting solutions. For instance my account numbers map to my accountants tax solution, so he imports my Xero data, and my taxes are finished in a few hours as opposed to a few hours.

Honestly the first time I started using Xero I hated how the account numbers come out so close together, how was I supposed to add any more accounts down the track. But after years of working in Xero, I realise that the account numbers don’t have a big impact on anything, other than mapping which I mentioned previously.

Account Types

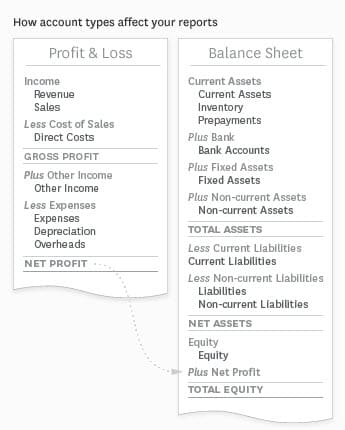

The MYOB chart of accounts is split into eight major types, while Xero has five major types. The high-level breakdown is as follows:

- Assets same

- Liabilities same

- Equity same

- Expenses – MYOB splits this out into Cost of Sales, Expenses, Other Expenses

- Revenue – MYOB splits Income, Other Income

MYOB has more major Account Types, but once you drill into the detail, Xero covers all the necessary basis in this regard. If you’re happy to leave it at that, skip to the next paragraph. If you want to know, map the MYOB Cost of Sales Accounts to Xero Expense Direct Costs. Map the MYOB Other Income Accounts to Xero Revenue Other Income. When it comes to the MYOB Other Expenses use the report customisation options to group them.

In MYOB you can reconcile anything that is designated Account Type bank. In Xero only accounts that you want a bank feed associated with, are set up as a a bank type, and they are the only ones that you can do a true reconciliation.

The functionality to cleanly reconcile clearing accounts is not available in Xero. There are several workarounds, none of which I have developed a fondness for.

The Account Name

In MYOB the Account name is a description of the general ledger account. In Xero, the name, in relation to the account type will determine the order. You can see the order the account types will appear in financial statements in the chart to the right.

In MYOB the Account name is a description of the general ledger account. In Xero, the name, in relation to the account type will determine the order. You can see the order the account types will appear in financial statements in the chart to the right.

MYOB has an undeposited funds and electronic clearing account which are not needed in Xero.

Tax Codes

Xero by default seems to use less tax codes than MYOB, and it works OK. Extra can be added if need be.

So that highlights the ins and the outs of the differences in the chart of accounts in MYOB and Xero, which is useful to know if you are choosing a solution