I just believe it’s actually the personal side of the profession. When you look at GL advisory, a lot of the deliverables are around an impersonal deliverable. We’re looking at forecasting, we’re telling the numbers and secondary to those numbers are people. Same thing with apps. We’re talking about automation, we’re talking about integration, real time streamlining. Once again, technology is first, people are second. People Advisory, in my opinion, now flips it, flips the profession to where I believe the next iteration of profession should go, which is okay, we’ve spent a lot of time talking about technology. It’s now to put people back into that equation. ~ Will Lopez, Head of Accountant Community of Gusto

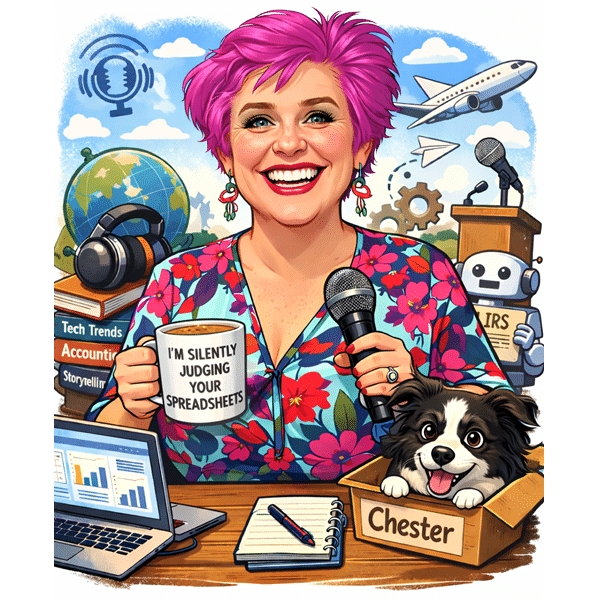

Today I’m speaking with Will Lopez, Head of Accountant Community of Gusto

As you may recall, Will came on the podcast only a few months ago, but today he’s back to talk about a new initiative that Gusto are launching, called People Advisory™ powered by Gusto. Gusto is based in the USA describes itself as an all-in-one people platform. There are five different elements of this announcement

- Gusto Pro.

- People Advisory Certification.

- People Advisory Tech Stack.

- Advisory Hub.

- People Advisory Playbook.

I found it interesting talking to him about how when he was working in his modern practice Advisorfi, he recognised he was not equipped to offer People Advisory. Through joining Gusto, he’s helping his younger self, and other advisors in the community to provide this service, and in turn help small business.

I think that it’s smart for Technology solutions to engage with modern advisors to design and deliver education for the community. Being nimble and upskilling with microcredentials, or nanodegrees, helps bridge learning gaps.

Plus I always encourage the Accounting and Business apps community to drip-feed educational content, and its great to see Will and the Gusto team recognise that too, and are empowering their community through education.

Hi, Will. Thank you so much for joining us on the Cloud Stories Podcast.

You joined Gusto one year and three months ago as head of their accounting community. At that time, you shared an article that Gusto was supporting 60,000 small businesses, but now on your website, it’s been updated to more than 100,000 small businesses. That’s massive growth in that short space of time. Is this because you’re such an awesome community manager? Did you see an impact, an uptake at the start of the pandemic or it has just been a steady growth or has it been something else?

Will Lopez: Well, I’d love to give myself all the credit, but I know that’s totally inaccurate. No, I think it’s just been very meticulous and diligent about solving real problems that small business owners have, solving real problems and real needs that they have and the accounting profession has. We just continue to help as many people as we can. Obviously, the pandemic really changed a lot of things, not only for everyone, but for us as well. It caused us to move faster. I think now we have over 40 product updates as it relates to COVID-19, in the United States, where it’s just an avalanche of legislation that came federally and state side that we had to respond to that was really around payroll and supporting your team. Yeah, I think we just continue to do what we do, what we love to do, which is help small businesses and help accountants help small businesses.

Heather Smith: It’s funny, because you live in a mountainous area and I live by the ocean and you call it an avalanche and I call it a tsunami.

Will Lopez: It’s amazing how quickly I changed my language coming from Florida, where I was by the ocean.

Heather Smith: And it would have been a tsunami for you.

Will Lopez: It would have been a tsunami.

I understand you have a special announcement to share with our listeners.

Will Lopez: Yeah. As you know, we had our Gusto Next on July 30th and we announced an amazing announcement for the entire accounting profession. It’s more than product. It was something that was bigger than Gusto and just kind of to rewind, it was one of the main reasons why I joined Gusto behind the scenes to really try to create a differentiating offering at Gusto. Then because I love my profession so much, it was about, what can we do through payroll benefits and HR that would up skill the profession, give a better opportunity for accountants to connect with their clients around that particular offering, because that offering is conventionally looked at as just merely compliance oriented. In modern accounting, we’re always trying to figure out ways to find more value and build more trust with the work that that gets outsourced to us, and so what does that look like when you’re talking about salaries and wages or the payroll mechanism.

Will Lopez: I guess so next we had People Advisory powered by Gusto, which is Gusto’s new offering for Gusto partners, for them to extend actually a new advisory service to their clients, fully powered by Gusto. There’s a little bit of product in there, but all of it is mainly about creating an additional service offering from the accountant to the clients that will help meet needs at that level. Very, very excited. It comes with a slew of new updates to Gusto. We have our People Advisory certification, which is now live at Gusto, which is a four hour e-learning course that teaches the employer, employer lifecycle journey of payroll benefits and HR, with fundamentals of each area, and then People Platform area, and then People Advisory component to the education as well. I’s basically cutting edge payroll education with modern advisory built into it, which is all really exciting.

What inspired you and Gusto to design and launch this innovative solution?

Will Lopez: Yeah, I think there are three things really. There has always been and continues to be, and always will be, a strategic need or a need from small businesses to connect with proactive advisors. You and I are very familiar with this, especially living in cloud accounting. The recent pandemic has obviously accelerated that need as it relates to a company’s team, but small businesses struggle. I think the statistic is something like nine out of 10 small businesses struggle in the current economic environment. As it relates to payroll benefits and HR, almost half of employees are stressed out about health insurance and benefits, reducing productivity. There is a direct correlation between a team’s happiness, a team’s healthiness and their productivity and performance within the business and their devotion to the business. There’s really not been a way for accountants to signal expertise around that.

Will Lopez: When you’re looking at not only like the past decade of like FinTech and automation, also another big need on the accountant side is there’s been automations replacing a lot of the compliance work accountants are doing. Smart software companies are replacing manual bookkeeping and accounting work and they expect to do so in the next 10 years. I think the statistic is almost half of the US employments here in the United States, is at risk of being becoming automated, including accountants. Really that forth looking firms are offering value added advisory services to stay resilient and to offset. Nothing new here. This is something that I think the profession has been struggling with for a good decade now, but as it relates to payroll, there’s just been no streamlined way for accounting practitioners like myself and their team and their firms, to become experts at payroll benefits in HR. Not creating HR advisors or benefit brokers, but just becoming more dangerous, so to say, as it relates to that experience for a client.

Will Lopez: There’s been no training designed for accountants that teaches a consultative framework, that they could use to advise clients on building a great place to work or a resilient place to work. Then lastly, there’s just been no way for accounting practitioners to signal expertise, to current and prospective clients as it relates to that level of services, that consulting service. When you add all that together, there was just a real opportunity to create something of meaningful value that was not product oriented, for the accounting profession to advance an area of practice life that has yet been advanced. It’s been advanced around general ledger. It’s been advanced around apps, cloud based apps, but nothing around payroll. This is not the first time or the last time somebody will innovate on an area of practice life that is a little bit lagging in innovation, but we think it’ll set the tone from here going forward that all other areas of practice life can be innovated just like this.

Who’s the ideal accountant for People Advisory services?

Will Lopez: Yeah. The ideal candidate is, quite honestly, almost any business owner you wish to extend your core expertise beyond financial and app work, into that client’s team, so supporting the clients’ team members, retaining, attracting and developing talent. I’ll tell you a story. Back at AdvisorFi, if I had a client that was in San Francisco, California, and San Francisco, California, is notorious for heavy regulation around small business owners and competitive comp plans, compensation plans. My client, I think in 2008, they had spent $450,000 on recruiter fees. Every single person they hired left three months after they joined that company. Here, the company had spent over half a million dollars, close to half a million dollars in recruiter fees to get talent, to join the company. Yet that talent was not staying around after three months. The only contribution I could really provide is that conversation, even though I feel like I’m a very progressive modern accountant, that’s very advisory leaning, I couldn’t advise my client around that area.

Will Lopez: The only thing that I could really offer was, why don’t you find a recruiter that just charges less. Clearly, it’s expensive. You can’t be doing this again. It was very weak and shallow, my advice. I had not built personally. Looking back now, I feel like People Advisory was such a deficit at Advisor FI, that if I were still in practice today, I would totally adopt it in order to accelerate and advance my advisory skillset. I lacked the ability to build domain expertise around the employee journey. Why were those team members leaving? What could I really do to speak to that? Because if I could solve that pain point for my client, that increases their margin. That saves that expense and makes it real. There’s a lot of opportunities and I think payroll is riff of advisory moments. We’ve built this product to help accountants figure those advisory moments out and to do the unique things that only they can do, and we cannot, and help them become an expert at that and provide real value to their clients.

Heather Smith: It’s interesting, because you’re kind of suggesting that it potentially is going to reduce costs around the whole HR process. However, not necessarily impact the employees end pay in terms of, there’s a lot of other costs associated with HR that perhaps can be reduced while moving the business forward, because if you have a good team and a good culture, the business is going to do well out of that.

Will Lopez: Oh, absolutely. I mean, that’s the reason why I personally sold my business, sold my home, moved my family to Denver, Colorado, to work with Gusto, because I felt like they had a culture that I admired,, that I looked up to, that I felt like I could be a part of. That change my productivity habits, which also changes the business performance as a whole, which is why even People Advisory is here to begin with. We believe that with People Advisory, People Advisory starts with payroll, extends into benefits and comes full circle at people operations. People operations is the concept of keeping employees first in businesses decisions and making sure that when you are employee first in business decisions, you make the right choices that best represent and include that individual at the table.

Will Lopez: I tell the story with People Advisory, that for the longest period of time accountants actually have been ignoring an unrepresented seat at the table of advisory. That individual or that seat that’s been ignored, has been the employee seat or the contractor seat. That party is affected downstream by the advice that I give to my client. As a progressive modern accountant, if I say, “Heather, use this app, make this business decision. Use these set of tech stack apps,” who is the party that falls prey to those processes? Well, yeah, you yourself, but then there’s a team behind you that feels the down flow of that. That party has actually been missing in modern accounting and not properly represented in the consulting of accountants.

Will Lopez: We believe that People Advisory now brings representation to that workforce that has not been represented by way of the advising that modern accountants provide. Because right now, modern accountants only advise over financials, maybe forecasting technology, but we’ve never created a framework that puts people in the employees team or the company’s team first, in those specific business decisions and People Advisory will do that.

What’s your favourite feature of People Advisory that you think everyone must know about?

Will Lopez: Yeah, so our certification will be your essential training to up level your expertise around this offering in this advisory moment. Within certification, there’s actually a deliverable that we have innovated called The People’s Story. We believe that by analysing The People’s Story, that the numbers tell advisors can lead discovery about teams and provide practical tools and resources that help them manage, help the client manage the employee journey. That People’s Story is a combination of KPI work through our integrating partner, Jirav, which produces six people planning KPIs, that will help monitor the financial health of not only the happiness of the team, but also the impact of the happiness of the team as it relates to the financials. It also puts into account financial statement analysis, what does the forecasting look like when we forecast out The People’s Story.

Will Lopez: Then lastly, through Gusto’s surveying tools, anonymous surveying tools, we can actually get a pulse of the sentiment of the team. Perhaps they’re not really connecting with the owners mission or vision, perhaps the owner’s not offering benefits or a certain way or retirement planning a certain way, which impacts and speaks into that people’s story. Telling the people’s story through your deliverable with KPIs, financial analysis and survey work, you can tell the real story behind the numbers. You can put a face to the financial statements on behalf of your clients, and then recommend the downstream practical tools and resources that bring that people’s story to life.

Heather Smith: It’s fascinating that you’re able to combine technology with people and actually surface this information. That’s really powerful for people, for accountants to be able to use.

Will Lopez: I was going to say, I mean, I’m excited and that’s why even our account dashboard Gusto Pro has advisory alerts. We actually have People Advisory alerts now available within Gusto Pro, which mines out your own client data and surfaces up those advisory moments. You can go then and talk to your clients about that. Perhaps they hired their fifth employee and now is a great opportunity to think about helping your employees save for retirement and build a better life for them and be personally prosperous later in their lives. Our dashboard would do that analysis for you, serve that data up and let you, what only you can do, and we can just surface to support that initiative.

Heather Smith: Absolutely. I really like that, the importance of surfacing the data to make an informed decision, and you’re in such a better place to make an informed decision, or to take that information to the small business owner and talk to them about it with your chair at the table or the advisory table.

To lean into People Advisory, accountants will benefit from developing their emotional intelligence. Emotional intelligence is not a magical trick. However, it is something that someone with a growth mindset can learn and can help an accountant have a rounded set of skills. Do you think the education provided within Gusto will help accountants develop their emotional intelligence?

Will Lopez: Yes. I think there have been a few things that accountants experience when it thinks about education. When you think about the blockers that accountants face, it’s generally the accounting profession is hinged on education. It’s hinged on learning and properly contextualising their trust, their value as it relates to the client, in a way that makes the most sense to both of them and their client. Through People Advisory certification, it offers much more than just product training, which is what the general experience is around certification courses like this, especially around modern certification courses. Ours is the first of its kind, never done before where we unpack each area of the employee journey and the People Advisor journey, which is payroll benefits and HR. We set a foundation contextualising the importance of the payroll mechanism, when you look back in history and why it’s here today and why Gusto plays such a big role.

Will Lopez: We do a little bit of product training around, here’s what the people platform compliance side of things are, and here’s what’s in scope for you, and here’s what’s out of scope for you, because we solve things that you don’t need to work on, so you could rise up to an advisor. Then lastly, we actually weave in the People Advisory framework that will give the accountant the confidence they need to actually signal real expertise to their client. In all, our certification really teaches you how to combine that financial expertise, along with a people platform to give proactive mission critical business advice for our clients. We believe it’s once again, the first ever badge of its kind. No other payroll or HR provider has a certification that helps accounting professionals stand out from the crowd and help them build real domain expertise around something like that. I, when I was in practice, took a lot of certifications.

Will Lopez: Certified in Xero, certified in Bill.com and so on and so forth. Much of that really gave me the confidence to speak Advisory to clients. It made me dangerous enough to know exactly what I was talking about. Albeit I may not be an expert at every nuanced area, but we believe People Advisory certification is a democratised version of the payroll experience and the employee journey and the employer journey, that we believe will set the tone for years to come, not only here in the United States, but internationally as well. We will look at our clients and their teams differently as people advisors.

Heather Smith: Yeah, absolutely. I think you organically are a person who has a very high emotional intelligence. It was interesting when you shared that story about how you recognised they had high recruitment costs, but you weren’t sure exactly where to take it to the next level. I’m sure with some of these conversations and learnings that you’ll get from the solution, which is possibly, probably one of the reasons you actually wanted to develop it in the first place, it will expand it for both people with high EI. I think people need to be open to that this is something that they can actually learn and grow from.

Will Lopez: Yeah. I mean, I look at advisory as an evolving journey and by no means, do I believe our profession is at an apex state when it comes to Advisory. There’s so many other areas that we need to be advising our clients on. The question really becomes, what is currently available for the profession to utilise, to help them build out that EI, that’s of real value to both them and their clients.

Heather Smith: Yeah, absolutely. Absolutely. I think we’re 20 weeks into a pandemic at the moment and a number of accountants have said to me, “I’ve never been so close to my clients as I have, because I actually had to talk with them. I got out from behind the monitor and I actually just talked to them and heard them cry, and were talking to them at 2:00 AM in the morning through their stresses, et cetera,” which is, I’m not suggesting that’s an ideal situation, but that having those further conversations is important.

Do you think that if someone achieves the People Advisory certification, all this certification within Gusto, they should specialise only in that area or they should perceive it to be a piece of the puzzle, of a piece of a bigger puzzle or sort of some hybrid in between?

Will Lopez: Yeah. Great question. I remember when I was coming up with the framework of People Advisory, and I believe that it is actually the third leg to what makes a transformational advisor so meaningful. When we look at where the profession has come from internet, desktop software, to cloud based accounting technology now, to client accounting services, to cast model, People Advisory is actually built from a reframed version of CAS accounting. I took the CAS model and I reframed it to figure out how we can deliver such high, valuable, premium grade advisory as it relates to that payroll experience and supporting the client and their teams. When we think about People Advisory as a real offering at a firm level, it actually is not a standalone offering, but can be complemented along with your other GL advisory offerings or app advisory offerings.

Will Lopez: I just believe it’s actually the personal side of the profession. When you look at GL advisory, a lot of the deliverables are around an impersonal deliverable. We’re looking at forecasting, we’re telling the numbers and secondary to those numbers are people. Same thing with apps. We’re talking about automation, we’re talking about integration, real time streamlining. Once again, technology is first, people are second. People Advisory, in my opinion, now flips it, flips the profession to where I believe the next iteration of profession should go, which is okay, we’ve spent a lot of time talking about technology. It’s now to put people back into that equation.

Will Lopez: Perhaps the profession has relinquished a little bit too much of its value around technology. People Advisory will be the third legged area to being a trusted advisor, to being a transformational advisor where people are first and technology is second. It will compliment and provide you a holistic approach to real advisory, which is more comprehensive of the business experience, because technology is important, but it misses the people element. Apps are important, but it misses the people element. Forecasting and financial extremely relevant, but it misses the people element. People Advisory doesn’t.

When you were still leading Advisor FI, what would your optimal employment cloud business stack be?

Will Lopez: Yeah, so I think obviously from a tech stack component, still big fans of Xero and Gusto and all the horizontal tech solutions that we would launch to streamline automation and innovation, but I will personally tell you, Heather, that I’m a little disappointed in myself, professionally looking back, having formed People Advisory as a real service offering, because there were so many conversations. I’ve could have added more value, helped my client more, really spoke around the real business experience, which is managing teams and all that kind of stuff. I wish I would have had something like People Advisory back at Advisor FI, because I feel like I missed it.

Will Lopez: I think looking back if I were to be here today, I would still do GL advisory work and app advisory work, but I would definitely roll in the People Advisory component to really round out my personal expertise and be able to speak to not only just my clients as the main stakeholder, but then my client’s employees, because they’re also stakeholders. I wasn’t acknowledging them in my advice when I would speak to the main stakeholder. Looking back, I feel personally convicted that I missed that opportunity, but I feel sober at the same time, because I know that there wasn’t any resource for me available at the time to actually help me figure that out. That’s why People Advisory exists today.

Heather Smith: I frequently refer to, I hope this doesn’t sound arrogant to people listening in, but we’re on the edge of this digital dirt road and people like you and I just build what we think we need to have for people to come along with us on the journey. That’s what you’ve done, that you and the team at Gusto have done, so well done to you for that.

What tips do you have for practices wanting to successfully adopt and roll out People Advisory?

Will Lopez: Yeah. At Gusto, our recommendation is obviously you get People Advisory certified because that’s what’s going to help you build the framework and understand how payroll benefits and HR really work together, and how you stand apart as the advisor over that process. At Gusto Next, we launched our People Advisory playbook, which is actually a 60 page digital eBooks that I wrote. That will give you a step by step practitioner’s guide to full change management around People Advisory. Everything that you would ever want in adopting a very progressive forward-leaning advisory service, that playbook will give it to you. I think just initially, just like what we’ve all been experiencing, you have to understand as a professional that the profession has changed and continues to change. I think in a recent Sage Survey, it said 90% of professionals globally that were surveyed said that there’s been a cultural shift in accountancy.

Will Lopez: There is a digital transformation moment and a business transformation moment. Personally, at least what I’ll say from here on out, is that for People Advisory, you have to understand that people matter, and that at least where Gusto is concerned, that Gusto helps you advise clients on what matters to people. That’s just been the missing component to the current modern accounting experience. We’ve all been kind of very excited about automation and FinTech, but I think now it’s time to continue on. We’ve spent enough time watching the waterfall and admiring it, but now it’s to hike forward and go to the next area of advisory, which is now people centric and making sure that our consultation and our advice is actually representative of the entire experience and not just pieces of the experience.

Gusto is a US based solution. How can and should advisors outside of the US, take advantage of these tools?

Will Lopez: Yeah. Great question. Jaclyn Anku, who leads our partner education programme here at Gusto, is the one who built out and fully designed the People Advisory certification framework, along with the learning management solution that it’s off of. Yes, Gusto serves the United States market, but I personally believe People Advisory is much bigger than Gusto and that any accountant anywhere could really utilise the frameworks found there in, in order to really think differently about advisory or augment their existing advisory skillset with that People Advisory framework. More to come on that as far as trying to get it more open to international partners and getting other non domestic accountants to benefit from the revolution and innovation of approach and service. Yeah, we’ll have more information on that soon.

Heather Smith: I will highlight to our Australian listeners something that would be happening in this space would be a specialist bookkeeper, not necessarily someone termed an accountant, but I think in America, the term would be encompassed by accountant. I think when Will is saying accountant, he is including specialist bookkeepers of this area as well. Please don’t listen in and feel that you’re being left out. You’re not being left out. It’s just different terminology across the ponds.

Will Lopez: Absolutely.

What does the next five years vision look like for People Advisory?

Will Lopez: Yeah, quite honestly, I think it’s to really change and take the profession into the next step of advisory. I personally believe that FinTech partners overall that are in our space, have a real responsibility and investing into the profession properly. This is just my personal take, but many tech companies have exploited the accountant and specialist bookkeeping channel by using the relationship between accountants and their clients as a sales channel. I do not believe that at all, and Gusto does not believe that at all. I personally want Gusto to redefine what it means to partner with a resource like Gusto. The next five years is to continue the narrative that, that we believe that partnerships should create opportunities for accounting professionals and not take them away, that technology can solve many problems, but not every problem can be addressed through automation alone.

Will Lopez: That when an issue starts with people, it should end with people which is very critical and even automation that makes generalisations, and doesn’t take into account the context of a business’s specific situation is harmful. That’s where the accountant element and bookkeeper element is so critical to the success of that business owner. Only they can connect the dots. Only they can actually take that GL and that app and that People Advisory moment and put it all together, and weave it and be able to really support their client short term and long term. Personally, I want Gusto to be fully committed to being a true partner to the accounting profession and to build things that are just not product oriented, but to really enable the profession, because the truth is the profession is busy.

Will Lopez: You don’t have the time and the profession has treated software companies conventionally and not really treated them as deeper partners or vice versa. Software companies have not treated the partnership as a real partnership, but more conventionally as a sales channel. I personally would like to change the narrative and level up that this is what you should expect from a resource, is to help figure out ways to increase your value, increase your trust while deliver real advisory and sustainable revenue.

Heather Smith: This is what you’re saying there is just like what I’m constantly saying to people in the app world, educate, educate, educate, empower, empower, empower, educate, which is what we want. Sometimes the institutions or the associations, the professional ones, are not at the leading, cutting edge, and able to provide it to us. We actually have to turn to organisations like Gusto or Spotlight Reporting or Futrli, who are providing sort of advanced education in that manner that we can use. Now, thank you so much, Will, for speaking with me today. I’m going to ask you, it’s kind of a funny question, but how can people find out more about People Advisory powered by Gusto? Because before I actually came on, I thought, “Oh, I’ll just type Gusto in Google and it will come up immediately with you,” but instead it came up with about 20 pizza restaurants in Brisbane.

How can people find more out, more about People Advisory powered by Gusto, which does not involve pizza?

Will Lopez: Yeah. Pizza is delicious and I wish Gusto would get into the pizza franchise. No, I’m just kidding. You can go to gusto.com/partners/accountants/certification, and you’ll learn more about our certification, about People Advisory. By the time you’re listening to this podcast or watching this video, all the information and the resources will be live for everyone to enjoy. If you follow us on Twitter at Gusto HQ, you’ll get more information about that as well. Follow our blog. We’re going to make a big moment for this, because I believe that not only is this a momentous moment for Gusto, it’s a historic moment for the profession to actually be able to branch out into new advisory moments, that’s fully supported and that properly positions the accountant in the right light and doesn’t detract value from them. If they go to gusto.com, there’ll be information on our landing page or for certification and for the People Advisory powered by Gusto offering.

Heather Smith: Thank you so much, Will, for joining us. All the best with the launch and rollout of your new product and services through Gusto.

Will Lopez: Thank you. Well, I’m excited. Many years of busy-ness to come.

Heather Smith: Absolutely.