Incite (definition) to move to action: stir up : spur on : urge on. Merriam Webster

Martin McLean of Team Race Bookkkeeping

On the first Friday in February I attended the MYOB Incite conference in Brisbane. I registered in early January for the event and then a couple of weeks later a confirmation email notified me that I could register for an additional segment called “ADD-ONS @ INCITE”. An additional three hours was tagged on to the end of the day, to provide education, demonstrations from the MYOB add-on community, plus networking and drinks.

There’s contention in the accounting industry about whether to call these business solutions add-ons, apps, or partners. Some of these solutions are bigger than the accounting product that’s referring to them as add-ons. When you’re exposed to these solutions, it’s worth remembering that while you may be coming to them from your specific angle and need, they may have evolved independently and in their own right, and are venturing into your world.

Does that make sense? Maybe another way to look at it – is they are fully self contained lego bricks, and are perfectly adaptable to make a firehouse, a pirate ship, or a Millennium Falcon. Or in your business world, a reporting, a payroll or and inventory management solution. Sometimes the field names won’t be exactly the same or won’t match up perfectly because they were developed for something else. As someone who’s been operating in this space for years, the good news is that many of the teams behind these solutions are listening and quick to develop if they hear a need for change. If there’s a demand, six weeks later the feature within the solution appears – now that’s really exciting.

I’ve been running a meetup for cloud advisors in Brisbane for a number of years and in the last six months more of the solutions have been advising me they are integrating with online MYOB solutions. MYOB has two online solution: MYOB Essentials which is completely online, and MYOB AccountRight which is similar to MYOB Classic that has been around for years and has the ability to move between being online and offline.

The MYOB Incite conference was set up in two huge halls, on one side a purple hue embraced the presentations and on the other side were exhibitions from various business solutions.

The MYOB Incite conference was set up in two huge halls, on one side a purple hue embraced the presentations and on the other side were exhibitions from various business solutions.

Highlights from the exhibitors at MYOB Incite included:

Tony Pearson the Director of Sales at Neto, told me that the Brisbane based ecommerce platform is launching a fully integrated inventory management module in a couple of weeks. Beau Gaudron the tech ninja at Growthwise pointed out to me that Neto have also released an integrated POS module. This fully featured ecommerce solution makes it an easy choice if you are serious about growing an online business. I love that they are Brisbane based too!

Catching up with Amanda Hoffman of My Office Books

Spotlight Reporting and Receipt Bank have also recently released integrations with MYOB products. This has led to a lot of excitement in the accounting and bookkeeping community.

Many thanks to ICB Australia and Deborah Thompson who provided comprehensive manuals on Single Touch Payroll. Read my article here Six Reasons Smart Australian Bookkeepers Love the ICB.

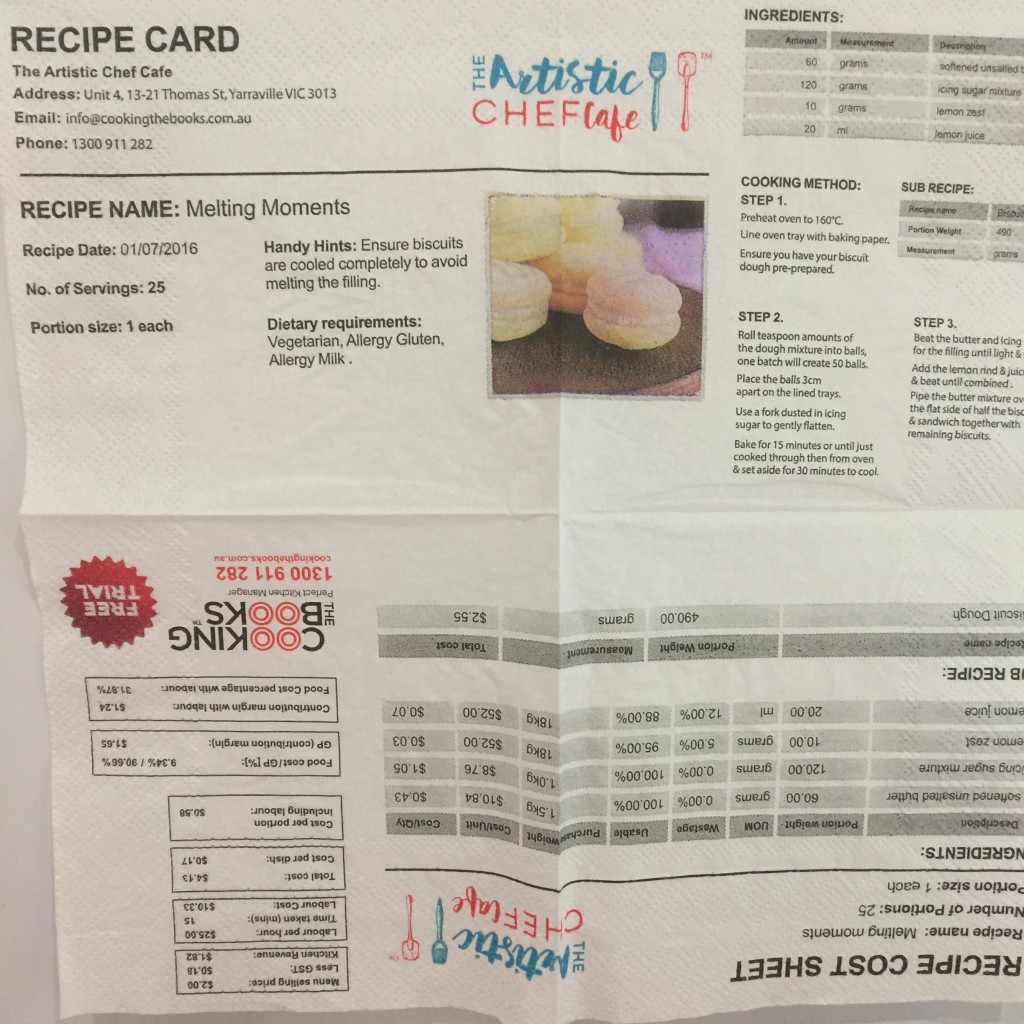

One solution that really piqued my interest – was Cooking the Books. I vaguely have some recollection of this solution, but the conference gave me an opportunity to talk with founder Andrew Briese. Let’s see if I can explain what it does…the chef defines the dimensions and requirements of each recipe, think servings, portions, handy hints, dietary requirements,ingredients, selling price, total cost, cost per dish etc. Users can then pull down the information from the recipe and use this to build detailed purchasing orders. Andrew clearly had fun coming up with the names for the three additional modules they have; Invoice Ripper, Drinking the Profits and Shifty Business. Invoice Ripper offers a line item extraction of invoices and pushes them in as detailed bills. We’ve not seen this level of extraction since Invitbox which was purchased and absorbed by Intuit QuickBooks. The solution is interesting and if you or your clients are serious about running a hospitality venture… do yourself a favour and take a look at Cooking the Books.

Showcasing what Cooking the Books does on napkins! Marketing genius!

I came across another reporting solution. David Egerton-Warburton showed me his online cash flow management and budgeting solution Reep. He also has a solution called agrimaster – for agribusiness. (I’ve not got any clients in this space – but worth noting)

I’ve seen the transformation that an integrated cloud business platform has on a business. The business needs to be ready to embrace the changes the technology can bring to it. As an industry we need more education and understanding of how integrated cloud business platforms can help our clients, and help small business access big data.

If you are on the cusp of exploring the cloud ecosystem I’d suggest:

- Implement and adopt a solution into your own business.

- Cherry pick clients and suggest some of the simpler solutions, such as Receipt Bank, to them. Work through the implementation. Once you are comfortable with the solution – you may then wish to partner with them, and recommend them to further clients.

- Ask your client base what additional solutions they are using. In my case what I have found is, yes they are using various solutions, and in some cases they did not have them fully or properly integrated, so they were not reaping the efficiencies of the solutions.

- Review your client base and identify if any solution may specifically suit a specific client. Here is a case study of how I implemented ReLeased commercial management software for a client. I had to learn the product and implement it – but it saved him a huge amount of administrative time, and improved accuracy of revenue.

- Don’t try to master all solutions. Yes you may have a specific client with a specific need, don’t feel you need to learn everything, try and specialise in an area that interests you and of course is financially viable!

As a cloud advisor once you move down the route of fully integrated cloud business platforms the time it takes do compliance work will massively reduce, (and I predict will be fully automated within several years). So my suggestion for the management accountants is you look at where the opportunities are in big data. And (oh! She started a sentence with an ‘and’ heaven forbid!) it’s not just the numbers from the accounting solution – it’s conversion rates, google analytics, cost per conversion, SEO metrics, inventory ratios, HR performance. Fully integrated cloud business platforms are going to provide a bucket load of data and as cloud advisors and management accountants our future is analysing and interpreting that data 🙂

Mick Devine from Calxa & Bree from Tanda

Work with businesses to identify what are the KPI’s or drivers in their business. Use Spotlight Reporting, Fathom, Float to develop reports, and start the conversation to help business owners understand and drive their business. Develop reports and dashboard the business owner needs, not what has always been given to them in the past