You can’t be half pregnant. If you’re going to adopt new software, new processes, new procedures, then damn well do it. Don’t just kind of go halfway through the process and not actually change your mindset and your processes and procedures as well. If you’re going to put in new software, look at everything, look at how it impacts your business, look at how it impacts the operation of your clients and everything, how that’s actually going to roll out before you actually do.

And then once you have looked at all of that and you’ve decided it’s the right piece of software, adopt it. Make it your baby and make sure that you’ve actually rolled it out and get the most out of that piece of software because time and effort has been invested in that. Sometimes even financial investment has been put in, because you’ve gotten Clarity Street to help you. So use it, basically. You can’t be half pregnant.

Today I’m speaking with Amy Holdsworth, CEO & Founder of Clarity Street

- Recommendations for someone wanting to start a modern future-focused cloud practice.

- Fast and Furious implementations that could provide some quick capacity wins

- Juggling change management, how to get the decision-makers across the line?

- Advice for someone in an old school firm that wants to automate, modernise and move to the cloud.

- How do you reposition the client lifecycle and get the most out of your software!

- How her side hustle, Red Coat Cake, helps her keep current with some different technology tools.

Heather Smith: Amy, thank you so much for joining us on Cloud Stories today. Can I start by asking you the icebreaker question?

Who is your favourite superhero?

Amy Holdsworth: Thank you so much for having me, Heather. My favourite superhero, I feel like it’s She-Ra, Princess of Power. Good old ’80s. Do you remember her? He-Man’s offsider. She-Ra. Oh, Princess of Power. Come on, Heather.

Heather Smith: Princess of Power. I’ll have to look that one up.

Amy Holdsworth: Yep. She was good. Late ’70s, early ’80s cartoons.

UPDATE The day the podcast went live this article She-Ra and the Princesses of Power appeared on The Guardian.

Heather Smith: Fantastic. Thank you very much for sharing that with us. I’m not sure what I was doing in the ’80s to miss out on Princess She-Ra.

Can you share with our listeners a bit about your background, Amy?

Can you share with our listeners a bit about your background, Amy?

Amy Holdsworth: Yeah, certainly. I presently run a company called Clarity Street. What led me to Clarity Street, though, is probably a number of different roles within the accounting industry, which started as a practice manager in the accounting industry. I then moved into a business which actually when Xero purchased WorkflowMax, which is now known as Xero Practice Manager-

Heather Smith: You actually worked at WorkflowMax?

Amy Holdsworth: I didn’t work at WorkflowMax. What I did do was when Xero purchased it, they actually … In Australia, they went out to a couple of businesses and they acquired a couple of businesses or got some businesses to onboard the clients. Instead of having it an in-house situation, they actually had some software vendors or accounting firms that had utilised the software that would go out on their behalf and actually implement for the industry. I was part of one of the first practice studio partner companies that was available.

Amy Holdsworth: Got some really good knowledge in how obviously accountants tick and think, and through my business and my knowledge of practice management solutions, that’s how Clarity Street was essentially formed. Prior to that, though, I’ve had a bit of experience in the hospitality industry, worked in the finance industry a bit, and I have a little side hustle, I’m a lover of cake. I decorate cakes. I bake, it’s my happy place realistically. But yeah, Clarity Street was formed because there is a need in the industry essentially for accountants to understand what software is out there, and that’s what we do. We take out the frustrations, we extract the frustrations from having to choose what applications choose with each other.

Amy Holdsworth: What connects with each other? How they work, what happens operationally when you actually use those pieces of software. That’s a bit of background about me.

Do you describe yourself as a cloud integrator for practices?

Amy Holdsworth: I would only because it’s an easy term to identify what we do. We do integrate cloud applications, but we also do so much more than that. If you had to pigeonhole us, yes, we’re cloud integrators. But Clarity Street is much more than just a cloud integrator. We holistically look at your overall operation in terms of your business, from a people, process, systems perspective, to ensure that all facets of the business are actually humming and working harmoniously together.

Amy Holdsworth: Because it’s not just about software. It’s not just about putting software in as a Band-Aid to obviously fix a solution. It’s about making sure that operationally, and functionally, not only do your team know what they’re doing, but your client’s also operating the same methodology so that the software can efficiently work. Because ultimately, software’s just a Band-Aid. If your people, process, and systems aren’t really all working together, then your software’s only going to be a good as the information you put in.

Amy Holdsworth: That old crap in, crap out adage, basically. You’ve got to be using it in the right way to make it the most efficient.

Heather Smith: Absolutely. You’re in one of those kind of difficult spaces that people don’t even know that they need you or that there’s a service. Many people don’t even know that there is this sort of service out there, and it’s sometimes, they find you through weird places in that someone refers you inwards, or they see a case study, et cetera. It is one of those very niche, difficult to explain areas.

Amy Holdsworth: Yeah, 100%. I couldn’t agree with you more. Realistically, in the space that we’re in, there’s probably only half a dozen operators within the Australian market that are doing this. In terms of what Clarity Street does, I would say that correct me if I’m wrong, I’m happy to be corrected, but we’re the only ones that look at a business holistically, from a people, process, systems perspective.

Amy Holdsworth: Lots of other cloud integrators do what we do and do parts of what we do, but I wouldn’t say that they do it in a full package application as how we operate.

Heather Smith: Yeah, absolutely. I try and sit in a global environment and look at what’s happening globally, and globally there seems to be less than 20 businesses out there who are actually doing this. It is great that Australia has a few to choose from, but it’s excellent that we have you on the show here today and people can actually here what you’re doing, and how you’re actually doing it. Very appreciative of it, because I do think that there’s a massive opportunity to do this if you can get into the businesses and they can identify that they need you.

Amy Holdsworth: Definitely.

How is your business navigating the COVID-19 pandemic?

How is your business navigating the COVID-19 pandemic?

Amy Holdsworth: It’s an interesting one. We’re in a really good space from the perspective of we’re getting lots more interest in what we do. Because all of a sudden, you’ve got a lot of accounting practices that have probably had to work from home all of a sudden, and their environment that they’re used to working from is no longer available to them in the current situation.

Amy Holdsworth: The first few weeks was all about how do you work from home successfully? That’s the first step. And then all of the JobKeeper stuff happened in terms of the legislation that was talked about a lot before it was actually legislated, essentially. We had a bit of a lull in terms of clients obviously wanting to speak to us. No doubt, I mean probably even clients who weren’t specific JobKeeper related were having trouble getting in touch with their accountants, because the accounting and bookkeeping industry, man, did they cop it.

Amy Holdsworth: In terms of just the knowledge that they had to engage with their client base, and I guess the counselling that they had to give their client base. From our perspective, our business, we took a bit of a backseat I guess, to a certain degree, whilst that all happened. But once the accountants and bookkeepers got their head wrapped around what actually needed and what was required from the client base, from the JobKeeper situation and COVID, things have actually started to pick up again.

Amy Holdsworth: Because it’s allowed the accounting firms out there, and we do predominately work with accounting firms, it’s allowed them to actually take a step back and go, “All right, how am I operating? What am I doing? I had this project in mind, I’ve actually got probably a little bit more free headspace right now because I don’t have to deal with all of the other facets of life,” so to speak. As in, this is my little, my environment that I’m working in right now. So, we’ve had quite a bit of interest recently of clients getting in touch with us.

Amy Holdsworth: I mean, in terms of myself and my business partner, Ian, how we’ve been working, realistically, if I’m not in a client’s office, I’m usually working from home anyway. So I’m set, I’ll be honest. I don’t have an issue with it. Doesn’t really impact me personally, but I think the only difference from us that it’s changed is we would normally do a discovery onsite with our clients. That’s step one of our process. After a client’s engaged us, we will always do an onsite discovery. Because as I said, it’s so much more than just software in terms of what we do.

Amy Holdsworth: The impact has probably been we’ve gone, “Well, instead of an onsite discovery, we’ll do a virtual discovery.” But in reality, that hasn’t really altered how we operate or changed it too much because it has allowed us to obviously still get in touch with clients and speak to clients and actually still service them in the way they’re used to being serviced essentially.

Heather Smith: Excellent. Thank you very much for that, Amy. For our overseas listeners, Amy referred to JobKeeper which is the part of the Australian government’s tax stimulus package, which everyone is dealing with their own tax stimulus package and everyone’s probably had accountants and bookkeepers in a similar situation as Australian ones were as well. So Amy, it sounds like in fact you do regularly work from home, but I was going to ask you…

What’s something you’ve learned from working from home?

Amy Holdsworth: Oh, no, no. I definitely have. You can always learn something new. I think that I’ve learned that I needed a new desk. I did go out and get a new desk which was great. I also worked out that I’ve changed my apartment around a little bit more, so I’ve moved my desk. I used to have it in a little, like a study alcove in my apartment. I now have a balcony outlook. I can actually see out my window, so I have a view.

Amy Holdsworth: The thing that I guess I’ve learned more than anything is working from home, it helps to have a bit of a routine, leave the house in the morning. That kind of thing, before you actually start. It also helps to actually really be focused, but more than anything, I think working from home, it’s helped to I guess for the industry that I work in, for me personally not so much, but the industry that I work in, I think the exciting thing here is that it’s helped firms probably identify that having a person in an office space so they can actually see them between the hours of 9:00 to 5:00 for example, is not necessarily a requirement anymore.

Amy Holdsworth: People are still just as productive in their own environment, if not more productive, when their KPIs are changed from having to be available between the hours of this and this, versus, “Well, I need this work done by this date or this timeframe, and there has to be a level of quality associated with it.” That’s probably the thing that I’ve learned the most is people can function and it’s wonderful to finally here that all of those people that work part time hours that may traditionally have found it challenging to be in a traditional office environment, because of old school mentalities about how you should or should not work, there’s a lot more flexibility around options and opportunities for work these days I think is the one thing I’ve noticed.

Amy Holdsworth: I think the only other thing that I’ve learned as well is that I’m quite thankful during this time that I presently don’t have children, because home schooling would be a pain in the backside. So yeah, they’re probably a few little tidbits that I’ve worked out.

Heather Smith: Yeah. It will be interesting to see how it plays out. So, to pull back to what you actually do.

What recommendations do you have for someone who wants to actually start a modern, future focused cloud practice?

Amy Holdsworth: Yeah, definitely they would come to us.

Heather Smith: You don’t have to give me all of your secrets.

Amy Holdsworth: No. If you are starting out in business, whether you’ve been part of an established firm and you’re deciding to breakaway and go at it alone, or whether you’ve just kind of been an employee and you’re just like, “Right, I want to actually start my own firm.” Whichever way you look at this, unless you’ve been part of a modern and proactive thinking accounting practice, the things that you need to takeaway from this process are that you have an opportunity to think differently.

Amy Holdsworth: And right now, just before you’re about to start that kind of thing, just before you’re about to start your firm, this is a time and the opportunity to rethink that client lifecycle process. And just because you’re used to certain pieces of software and you’re used to certain ways of dealing with clients doesn’t necessarily mean that that’s the most efficient way of doing things and the most efficient way of dealing with clients.

Amy Holdsworth: I think the other thing to remember is your perception of a client’s reaction is what will hinder you to move forward as opposed to the reality of the situation. For example, I know that lots of accountants out there really struggle with their branding and their logos and the layout of their letters, and their fonts and things like that, to make sure that they have to be schmicko so the client sees things like that.

Amy Holdsworth: In reality, your client doesn’t care, ultimately. Your client pays you for your service and your knowledge and because you have a certain skillset. They don’t pay you because of the way that your letterhead looks when you send them the cover letter for the financials that you’ve just done for them, okay? They’re the types of things in terms of perception, like upfront pricing. Requesting payment upfront, hypothetically speaking, we are a big advocate of that because it streamlines your process and makes you more efficient.

Amy Holdsworth: The only thing that’s stopping you from doing that is your fear around the perception of what your clients will do and say. Not the reality of it. You might get a couple of clients that push back, and that’s okay. They go into the 5% of clients that you handle in a bespoke way. The other 95%, they’re going to love it. They won’t even question it, because that’s the way that business is done. The main things to takeaway from it is you actually have an opportunity to think differently, so do think differently. There’s wonderful pieces of software out there now that actually support different ways of doing things.

Amy Holdsworth: The old MYOB system for example, MYOB AE, just using that as an example, it doesn’t really handle upfront payments very well. Because it’s a very traditional, time cost, billing piece of software that you would use to do your invoices at the end. The software out there these days can handle upfront pricing. That’s just one difference that you can look at. Anyone starting out new and fresh, just think outside the square and obviously Clarity Street can help you with that.

Amy Holdsworth: We do a day in a life of a cloud accountant demo with anyone that wants to talk to us basically. We actually take them through the client lifecycle process, start to finish, this is how you … The whole process. This is the traditional method of how you probably thought about things or run things, versus this is the new way of thinking about things. Reordering that client lifecycle so you can be more efficient, but also here’s the software that now matches that, and how you could actually operate it as a business.

Heather Smith: Yeah, absolutely. It’s really interesting hearing you say that now. My follow-on question and I ask this question because I know that I will have people who are currently sitting in an old school firm, they don’t know what the next step is. They don’t know how to move to modernise or where they even start, because the task is so huge.

What recommendations do you have for an old school firm that actually wants to automate, modernise, and move to the cloud?

Amy Holdsworth: Step one is speak to people like ourselves, obviously. There’s also the other thoughts of go to events. There are so many really good events in a different format in its present state, given where the current world is at right now, and working from home and things like that. But there’s so many free events that are out there, even paid events that you can help understand what opportunities and what options there are out there for software and how to modernise your firm. That’s the first thing.

Amy Holdsworth: Your peer groups, most firms, most businesses are part of some sort of peer group situation, whether it’s online, whether it’s through your monthly coaching calls with that kind of situation, or even your discussion groups. Whether it’s your CPA, CA, IPA, based in Australia, or wherever you are globally, that kind of thing. Speak to what everybody else is doing. No doubt, the reason why you had decided why you want to move and to modernise is because you’ve heard people talking about it. That’s the reason why.

Amy Holdsworth: You’ve had industry experts talking about it. Ask them questions. Sign up for demos of software. Free software that they all give you free demos and things like that. Sign up for them, play with them. But also understand why you’re wanting to change and what you’re actually wanting to achieve here. I think that’s probably the first thing is why do you want to change? Are you doing it just because you think that that’s the right thing to do, or do you think that it’s actually really going to make an impact to your business and to your client base? Because ultimately, the reason you should be changing is for your own business model, but also to serve clients in a better way.

Amy Holdsworth: Understand why you’re changing, that’s the first thing, and then obviously ask questions. I mean, there are obviously people like us out there as well, that we can talk you through that process. I mentioned before that we do a day in the life of a cloud accountant. Understand, do your due diligence. Go and ask loads of questions of all people. Listen to podcasts like this.

Heather Smith: Absolutely. Thank you very much for the spruik there, and I know that the Chartered Accountants did a good podcast also on modernising your practice, which is another useful one to listen to, which in fact featured you didn’t it, Amy?

Amy Holdsworth: It did. I think that’s a good point to note actually, is that the industry bodies are actually doing a lot these days. Sure, 10 years ago, when cloud accounting became the hip new thing that everybody had to do, they probably weren’t necessarily up with the times and supportive of that. Whereas over the last couple of years, they’ve really picked up their game. I would suggest that most industry bodies are now really trying to push the industry to actually modernise.

Heather Smith: Yep, absolutely. Because I started my practice over 11 years ago and I didn’t know what it should look like. I just started, and there’s only me here, so I had to use all of the robots available to me if I wanted to achieve anything. And because I didn’t know what it looked like, it just evolved from there. What length of time would it take a motivated, old school firm, to modernise? Now, I know you can’t give me a specific time, but give them something that they could at least start thinking about in their mind.

What length of time would it take a motivated, old school firm, to modernise?

Amy Holdsworth: For example, if you were to engage Clarity Street to assist you with this process, we actually do a 12 month programme with you essentially. We discover, we implement the new software, which usual takes 3-4 months. The actual software implementation doesn’t take that long, I’ll be honest with you. It’s the change management, the training, the bedding down of everything that goes on. And then we support you throughout the remainder of that time, because you will push back, you will try and go back to your old ways of thinking, and you will despite the fact that originally you were like, “I really want to do this,” there’ll be things that you’ll be like, “Oh no, I don’t think I can handle this anymore. I don’t think I want that much change.”

Amy Holdsworth: Realistically, it will take probably 12 months. We suggest though, that it probably takes closer to 18 months to two years. It’s 12 months if you work with us, we work with you for 12 months, but in reality, probably two years. A full tax cycle I think is the best way I can say it. You need time prepping to get ready for it, so probably 3-4 months before you decide to go, “Right, this is the near way we’re launching this new piece of software” or this new entire way that we’re going to work with the business, from new software applications and things, in a more modernised way.

Amy Holdsworth: You need probably a full tax cycle in theory, so that you’ve had a touchpoint with every client throughout that process. And then a couple of months after that as well, to iron out any kinks in the processes and the procedures in the software that you probably implemented. Yeah, in reality, 12-18 months is a good ballpark in terms of how long it will take to change in reality.

Heather Smith: Yeah, absolutely. And 12-18 months is doable. Is viable, both Amy and I have seen businesses that have started that journey and have got to the other side of that journey. And the great thing is now, sitting here in 2020, there’s people who can assist you and support you, plus as Amy mentioned, knowledgeable peers who potentially have done that and you can bounce ideas off.

Heather Smith: Amy, many practices have been unexpectedly very busy dealing with the government tax stimulus, which we’ve been talking about. Compounding that here in Australia, they’ll be heading into a busy tax season.

Is there any opportunity in this time for them to give themselves some capacity? Are there any low hanging fruit they could implement, fast and furiously, to make life a bit easier? What should they be looking at? Is there anything quick and dirty you can share with us?

Amy Holdsworth: Quick and dirty? I think the things that you can look at is look at the different functions of your business I think is a quick way of doing it. What function is the most annoying thing that you have to deal with right now that frustrates you? That would be probably a low hanging fruit type situation. For example, is your engagement process with your clients really annoying and you need to update that process?

Amy Holdsworth: Now is a perfect time to do it because ultimately you’re about to engage in a new tax season if you’re in Australia. 1 July, new tax season starts. Get your engagement process up and running. Look at pieces of software like Practice Ignition or GoProposal or those other options. They are one that is quite … It’s quite simple to implement with an open mind, basically. That’s a quick one. You can look at how all of your clients are actually, how you’re contacting your clients in terms of requesting information.

Amy Holdsworth: I think one of the other quick and easy things to implement is a good old fashioned lodgement programme or a work schedule. There are a vast majority of tax accountants out there that especially in Australia, that probably don’t actually utilise a lot of different programmes. What I mean by that is this is the compliance work that you need to do as a tax accountant. Not everybody is that, which I understand, and I appreciate, but if you do have that, get a lodgement programme which obviously schedules all of your work in, so that you know what work you have to do.

Amy Holdsworth: That’s an easy, that’s an Excel spreadsheet. That’s a download from the ATO Portal if you’re in Australia, and that’s an easy way that you can start looking at when you can start calling work in. That’s probably a couple of quick wins that you’ve got. I would also given the date at the moment, I would be looking at trustee resolutions, get that kind of stuff done. From a process procedure perspective, start pushing that kind of stuff out. But I think the engagement process is probably the easiest one.

Amy Holdsworth: I’d also probably look at if document management is a frustration in your practice, that’s actually usually a pretty good quick win. That’s probably a month turnaround. If document management is a frustration for you in terms of how you’re saving information, how you’re engaging with your clients, how you’re communicating with them, saving email content, that kind of stuff, that’s another quick win that you can actually look at which is usually good.

Amy Holdsworth: The two that we recommend is SuiteFiles or FYI Docs, two of my favourites. As I said, that’s probably about a month turnaround and usually something that isn’t too mentally challenging for your team to take onboard as well, because that’s probably the other thing that you need to be mindful of, especially at this time.

Heather Smith: Yeah. Just the adoption of some of that technology that you’ve mentioned there, which is all tried and tested, and used by many, many people in the industry, can save you hours in the week or the month, giving you potentially that capacity during the challenging tax season.

Amy Holdsworth: Yeah. I think Heather, I was just going to add to that I think as well, is also to not think that you actually have to do it all yourself. There are people out there that can assist you, and if you are bogged down with doing a lot of compliance work, or accounting work, whatever the case is right now leading into a new tax season coming up, there are professionals out there that can actually help you make the transitions and the changes that you want to change, which will allow you and free you up with your time. You don’t have to do it all yourself. I think that’s something to remember.

Heather Smith: Absolutely. Thank you for sharing that. I’m not sure whether you’ve completely addressed this, but I’ll ask it and see what you think.

How can a process or procedure be made more efficient?

Amy Holdsworth: Step one, what’s the outcome? What are you trying to achieve? Start from the endpoint and work our way back. A process and a procedure essentially should be transferable. It shouldn’t be personality specific. It should be role specific. For example, it should be this is a function, a process, a procedure, that an accountant has to do. Not a specific person fulfilling that role.

Amy Holdsworth: Don’t make a process that isn’t transferable, that’s the first thing. The less touchpoints and the less steps within a process, the better. The less human touchpoints in the process, the better basically. I’m obviously a big fan of automating as much as possible. By the same token, there are still things that us as humans, that we need to be there, we need to be a part of the process. I’m not trying to remove humans and just put robots in. That’s not what I’m trying to do here.

Amy Holdsworth: But if there’s an efficiency gained by having software that connects with another piece of software, then use it. But also don’t just change a process and a procedure because it’s annoying one client across the board. That’s something to be mindful of. If you’ve come across two or three clients that have gotten upset with a new thing that you’ve tried to roll out, that doesn’t mean that the other 95% of your client base is going to be annoyed and frustrated with it, okay? Just be mindful of that.

Amy Holdsworth: If it comes to changing processes and procedures, I think you need to look at an 80/20 rule. If I change this process or procedure, will this fix 80% of my problems? That goes for software implementation as well. Am I implementing a new piece of software because it solves 80% of problems, or am I just implementing this because I have three clients which I think this is going to really suit, so therefore I’m going to implement it across the board? You don’t want that.

Amy Holdsworth: Start with the endpoint in mind. What am I trying to achieve from a processes and a procedure? And then work your way back. Rule out as many human touchpoints as you can, look at the software that you already have, and look at the way you’re using the software, and see if the software can actually integrate or talk with each other in a much more efficient way. That’s how I would be looking at your processes and procedures, but also not to mention, traditionally lots of firms have always loved the good old fashioned process and procedure manual.

Amy Holdsworth: I think there’s something to be said for that, which is the landscape of this environment changes quite frequently. Either a piece of software will change, or something will become more efficient just by nature of how the industry is changing. For example, the way that you collect payment. Those options might change, basically. Just be mindful of how that software is actually going to impact, basically.

What solution do you hold your process and procedures in? What’s your favourite one?

Amy Holdsworth: We quite liked Process Street. That is one that we look at. Also not to mention, the document management solutions that I mentioned, SuiteFiles, FYI Docs, I think they are other good options. Processes and procedures do change, so you need to have an adaptive platform for them to change. Keeping them in a printed manual is probably a little bit old school and out of date these days. Not to mention, a lot of the software applications actually have help articles, help desk articles, and videos and things like that.

Amy Holdsworth: The other thing that we’re really, really big fans of is Loom. We love Loom. Video the process, so instead of having someone sit there and type out step-by-step, step one, this is what happens, step two, video it. Video your screen. You can talk to the process, you can talk to what’s going on. It means that if something does change in your process, you can actually re-video it very quickly, very easily, and you’ve got that new link saved and, “This is the new version of what we do.”

Amy Holdsworth: If you do do it through Loom, you can organise the videos through there. You can also upload your videos into a different platform if you would like and save them into some sort of a shared internal operation type software.

Heather Smith: Yeah, absolutely. I’m a big fan of Loom too. Interestingly enough, Process Street frequently are the highest performing articles in my newsletter.

Amy Holdsworth: Really?

Heather Smith: That blog from Process Street. Yeah. They’ve got some crash hot blog writers over at Process Street.

How do you assess a technology solution will be the right fit for the practice? Do you work with recommended tech stack, or do you suggest different solutions for different types of firms? How does the accountant, or the bookkeeper, keep up with the latest technology? Or, do they need to?

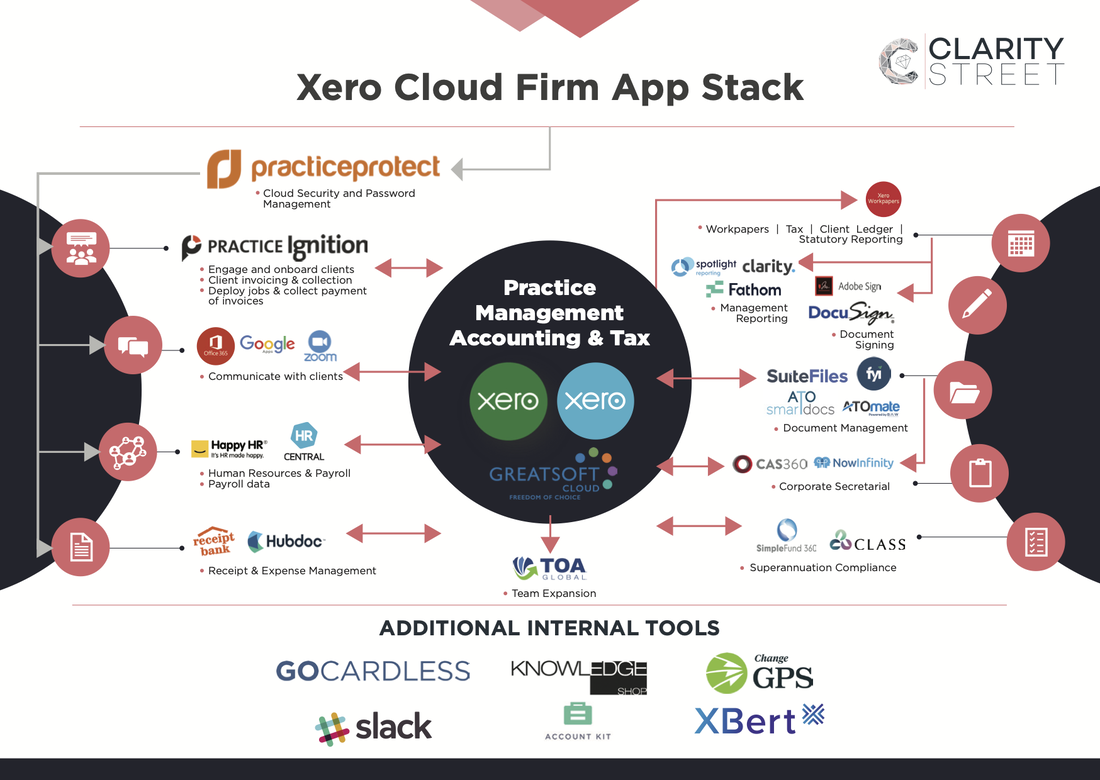

Amy Holdsworth: We recommend a Xero based app stack. I’ll be honest. Because it is the easiest to integrate other applications into. It has open APIs which means that the other applications can talk to the other application ultimately. Which means that you have a single source of data truth. So, if you update somebody’s name and address in Xero Practice Manager, it’s going to feed through to other platforms which are connected to that.

Amy Holdsworth: Whether it’s your corporate secretary or whether it’s your self-managed super fund software, whether it’s your engagement software or document management, all the information’s going to talk with it. That’s the reason why we promote that particular application stack. For larger firms, there are other options. Ultimately, we would recommend GreatSoft which interesting point to note, actually still utilises Xero Tax.

Amy Holdsworth: Ultimately, you’ve still got that single source of truth in that situation. We do look at other applications and we are abreast of other applications that are out there in the marketplace. we have an app stack which is on our website, which is what our recommended app stack is, and the reason why is as I said, because they all integrate, which means you’ve got the greatest efficiencies. There are some great pieces of software out there, and for example, I love Karbon as a piece of software. I think it’s great.

Amy Holdsworth: There’s other document management solutions out there which are also as equally … Sorry, not document management. Practice management softwares, that are equally as great and robust. They don’t talk to a tax platform, though, which means that you’ve then got a disjointed process, which means that you’ve got manual data entry between your tax software if that’s what you do, as an accounting firm, versus your other workflow software.

Amy Holdsworth: There’s lots of practices that will run a secondary workflow software on top of Xero Practice Manager. I don’t really understand that because it does what it needs to do, but that’s fine. Because I don’t necessarily like the look and feel of the workflow, but ultimately there are lots of other peripheral pieces of software that you can use, which go outside of the scope of what we talk about. We know of them, we think that they’re great, but until they open up their APIs and they can integrate cleanly and softly, smoothly through to the other applications, the main operational software platforms that you use, there is going to be a disjointed process. That’s where frustrations come, when information isn’t correct. That’s where you get issues, basically.

Heather Smith: You, absolutely. Thank you for sharing that.

In terms of keeping up with the latest technology, do accountants need to focus their time doing that, or do you think once it’s implemented, as long as it keeps updating the features, you should be okay?

Amy Holdsworth: I’m a bit of a fence sitter on that one. I think there’s partly yes, you do have to know what software is, what’s going on in the software industry. I think that it’s valid and relevant to know what’s going on, in your space, in terms of especially if that is an interest to you. Also, it’s always good to know what other applications there are that are out there, that might enhance the way that you do business, or enhance the client experience at the other end.

Amy Holdsworth: Whether you need to know every single element of every single piece of software out there, no, you don’t. Because you’re an accountant. I mean that with no disrespect, but you’re not in the technology and IT industry. You’re in the accounting space. So, focus on what you do well, which is servicing your clients, because that’s why you’ve got clients. Whilst having a knowledge is great and you should have a knowledge, by as I said, by going to industry events and things like that, I don’t think that you need to be across every single feature and change and application that comes out there.

Amy Holdsworth: Because if you’re changing just for the sake of change because you’ve got this shiny new toy that you think is going to fix this one little thing that’s annoying you within your tech stack, you probably don’t really need to do that. Like, there are other things that you can do within your business that will enhance the service that you’re providing your clients.

Amy Holdsworth: As I said, unless it’s going to solve 80% of a problem that you’re trying to fix, don’t implement a new piece of software just for the fun of it, because then you do get that overwhelming feeling of there’s so many applications out there.

Heather Smith: Yeah, absolutely agree with you. I do think one of the things I suggest to people is do some further training with them. Watch their latest features video, and I know even say when I deal with my marketing solutions, if I go and watch their latest feature release, I’ll find maybe three or four things that I can just tweak here and there to actually improve the way I’m operating. That’s a nice 30 minute time saver, 30 minute investment that can save you time down the track.

Amy Holdsworth: I was just going to say, every SaaS product out there has customer success these days. I’ve been customer success in a previous role when I was working at Practice Ignition and that’s what my job was, was to make sure that my client base was getting the most out of the features of the particular product. That’s the whole point of them.

Amy Holdsworth: If you don’t feel like you’re getting the most out of the application, speak to the product that you’re using. Get in touch with them. They all have account managers or customer success managers. They’re there to help you get the most out of using a product, so speak to them.

Heather Smith: Yeah, absolutely. We have a question from the community. Da, da, da, da, da, da. Electra Frost has asked, she’d like to know

How we can most effectively convince software providers to hasten features requests and improvements to make things work the way we need them to work, especially the obvious fixes. What are your thoughts on that?

Amy Holdsworth: Well, it’s a bit of a loaded question and I think I can answer this one based on the fact that I’ve sat on both sides of the coin. Because I have sat, as I said, I worked at Practice Ignition, so I understand the dev team and what they go through and things like that. I think something to be mindful of when feature requests are happening is you have to put your IT brain on for a little bit and understand first of all, just because you want that feature request and you think that it’s obvious that that feature require should actually happen, doesn’t mean that majority of accounting firms out there do think that that’s a feature request that needs to be bumped up the line.

Amy Holdsworth: You also have to understand that there are a number of probably other bigger projects which are going to enhance the software overall, which are going to service a lot more people. There’s also a timeline. There’s also budget constraints. There’s also so many hours in the day. IT providers can only make so many feature requests. I think the forums of being able to vote for feature requests and things like that, I know all the products that we work with are consistently looking at the amount of votes that those feature requests get to see how they can bump them up the line.

Amy Holdsworth: The other final point that I’ll note is one of the major feature requests that’s been asked is the tax return and the financials out of Xero being able to be sent as one holistic pack out of Xero Tax. Now in beta, which is great. That has been on the radar for the last 6-7 years for them developing that. The reason why I bring that up is one of the constraints, one of the major constraints in that was the fact that there were two different platforms.

Amy Holdsworth: Now, trying to bring those two platforms together, you’ve got although new technology, slightly older technology, versus new technology. Like, new, new technology. Bringing those platforms together, it’s not as easy as what we might think that it is. Like, to us, you sit there and go, “Why can’t you just make that bit do that? And then that’d be easy, that’d be a great fix.” It doesn’t always work like that. There’s a lot of things that interact with those little feature requests, enhancements, and changes that might actually break a larger part of the software basically.

Amy Holdsworth: They have to think about the architecture of the overall platform before they can make those little tweaks and changes. Yeah, cut them a little bit of slack, but I get it. I mean, it’s software that is ever changing and evolving and they do move pretty quickly in the grand scheme of things, but sometimes we just have to be a little bit patient.

Heather Smith: It is funny that we spent a decade with software that barely made any improvements, and now we’re on a software and it’s like if there’s not a new update in eight weeks, we’re like, “What are you doing, guys?”

Amy Holdsworth: That’s exactly it. That’s exactly it.

Heather Smith: I’d like to talk to you about change management.

What advice do you have for staff sitting in firms who want their firms to modernise but can’t get the decision makers across the line?

Amy Holdsworth: Tough one. I’ve been there. I understand. Look, communication is the first thing that is key in all regards to this. If you’re a team member that’s sitting there going, “Why aren’t we doing this in a more efficient manner?” I think the thing that you need to start considering is what steps can you take to actually show a test case or a reason for the change? Can you show some quantifiable evidence as to why this will improve and enhance the experience? For not only you, because ultimately it’s not all about you, as the employee. More so, what is the experience going to be with the clients?

Amy Holdsworth: If you can show some sort of anecdotal evidence, whether it’s by speaking with your peers at another firm, that they might have gone through these changes, or speaking to people within the industry, because that’s again, why you’ve sat there and gone, “Well, I want to change to a more modernised way of thinking,” getting that evidence to help put a test case and put a case in front of your directors and partners to say, “Hey, can we investigate this,” that’s going to be the first steps.

Amy Holdsworth: You’re going to have to be patient. I think if you’re sitting there going, “You’ve got an old school business model.” There’s a reason why the accountants, the directors of that business are probably a little bit old school. You have to be mindful of how you approach these changes. Look at small wins. Little things that you can do to show efficiencies. For example, I’ll go back to the payment example. If you send out invoices and you accept checks for example, from your clients, and/or you don’t have a payment gateway integrated with your invoices, a click to pay now feature, that’s a really quick, easy win that will show your directors that, “Hey, this modern technology’s not so bad.”

Amy Holdsworth: The client will start using it, and then the next thing is, once the clients actually utilise that new feature, get a bit of feedback. Ask the client, “How did you find that? Did that work?” That kind of thing. That’s always a good positive way of showing the directors of the business that, “Hey, these changes that we can make are really good, quick wins.” If it’s from the accounting space, looking at different ways that you can enhance your processes and procedures, the way that you operate to make things more efficient, that’s always going to be a win.

Amy Holdsworth: Also, get your team onboard, get your other fellow team members onboard with the changes. Speak to them, because you’ve got the collective power of your fellow team members that might want to actually impart these changes as well. Accountants want to see the value in change. They need to understand why they’re changing, and also they’re going to want to know how much it’s going to cost to change.

Heather Smith: The case study’s always very important.

Amy Holdsworth: 100%.

Heather Smith:

Do you think considering the pandemic and the current crisis that we’re going through, change management of what we knew before we went into this period, and then towards change management afterwards, is going to be less of an issue?

Amy Holdsworth: I really hope so. I think the push back when it comes to change management will be greatly reduced, because ultimately this whole pandemic and having to work from home basically forced the hands of a lot of employers in terms of the way that they were working. Having the ability to work from home, see that their team is able to work from home, I really hope that that does actually break down those barriers, and the resistance to change will actually be decreased, so that they can operate in a more efficient manner moving forward. I feel like it will, just by nature of the fact they’ve had their hand forced, basically.

Heather Smith: Yeah. I would encourage people to strike while the iron is hot and push for it now. Push for it quickly, push for it hard, get those case studies written up, contact your peers. What do you mean, Amy, by reordering your client lifecycle?

What do you mean by reordering your client lifecycle, and how do you reposition the client lifecycle and get the most out of your software?

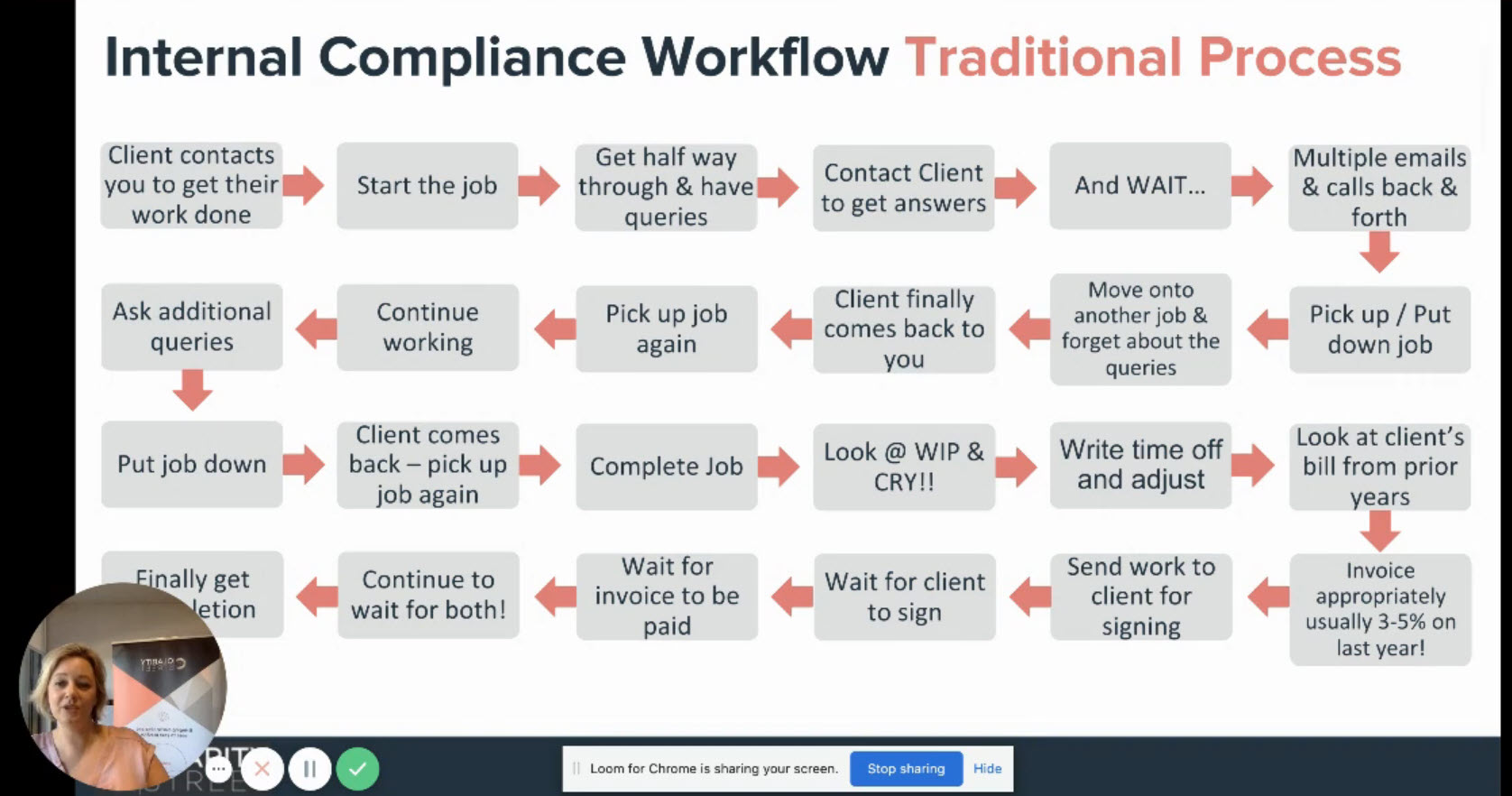

Amy Holdsworth: Good question. Traditional method is you will generally be quite reactive to your client needs. You will wait for your client to contact you. When they are ready to send in their information to get their work done. You’ll then pick up the job, you’ll start doing the work, you’ll get five minutes into it, work out that there’s lots of bits and pieces of information missing. You’ll contact the client with a long list of things that you require. They might send back 3 out of the 10 pieces of information.

Amy Holdsworth: Good question. Traditional method is you will generally be quite reactive to your client needs. You will wait for your client to contact you. When they are ready to send in their information to get their work done. You’ll then pick up the job, you’ll start doing the work, you’ll get five minutes into it, work out that there’s lots of bits and pieces of information missing. You’ll contact the client with a long list of things that you require. They might send back 3 out of the 10 pieces of information.

Amy Holdsworth: You’ll then get three pieces of information, pick up, start working on again, foot down, because you don’t have enough. Pick up, put down, pick up, put down, throughout the whole entire process, until you finally get to the point where you’re like, “Okay, I can now complete this job.” Raise an invoice, look at the time on the job if you’re doing time sheets and you’re billing in a WIP based method, and you look at that and go, “Oh, my gosh, there’s no way in hell that my client’s going to actually pay that because I put too much time on the clock.” Not always, but a lot of the time.

Amy Holdsworth: Look, I know that they’re probably going to pay this. My gut feeling’s that. Look at last year’s. Yeah, about a 3-5% increase, because that’s usually what happens anyway. No major anomalies. Raise the invoice, send it to the client, and then wait for the client to pay it, and then wait for the information to come back signed, and then you can finally lodge. Traditional methodology, 90-120 WIP lockup days. That’s a lot. It’s a lot.

Amy Holdsworth: Reordering the process, you’re still going to do all of those bits. You’re still going to do all of those elements. You’re still going to do the work, raise an invoice, get paid, lodge something, complete the work, communicate with your client. Reorder it though, so it’s more efficient. Have a work schedule lodgement programme, call that work in, actively call that work in from the client six weeks in advance. Keep following up until the work arrives in the office. Admin do that role.

Amy Holdsworth: Once the accountant receives, like once the work arrives in the office, the accountant scopes it. “What did I do last year? How much time did I spend? What did I bill the client? Is there anything missing?” If there’s anything missing, you get that work in then and there. Then you create a proposal where you recommend Practice Ignition. Great, that proposal, turn payments on, make it a required feature for easily 95% of your clients.

Amy Holdsworth: Send the proposal to the client, it gets accepted, payment is taken, you’ve been paid, happy days. You start the work. You’ve got 14-28 days, depending on what type of work it is. If it’s a basic piece of work versus company related work, 14-28 days. Because you’ve already got the work, because you’ve scoped it and you worked out what was missing, you can get that work done within that time frame. Not to mention because the client’s actually paid you, there’s going to be this psychological push for you to get it done much quicker.

Amy Holdsworth: If the client pushes you to get it done quicker, or you are pushing yourself to get it done quicker because the client’s paid, well that’s a win overall. Same process after that happens, and you review points, the client’s going to be more likely to get the queries back to you because they’ve paid for it, and if they don’t, well who cares? You’ve been paid. Basically, keep following up.

Amy Holdsworth: And then nothing changes. You review it, you prepare it for signing. Then you have a meeting with the client, and you’re done. That’s what we talk about in terms of reordering the client lifecycle. All the same things that you do but in a different order that makes you more efficient.

Heather Smith: Absolutely. It is interesting seeing the community talk at the moment. Typically BAS agents who are doing work on a monthly or quarterly basis are constantly chasing the business owners for documents. But a BAS typically results in paying out money, and now getting those documents together means they actually get stimulus. They actually get money back. They’re saying, “These clients who never had any of these documents et cetera together are now getting them to me on the 1st of the month, so it is interesting to see whether they can get them in the habit of submitting everything as quickly as possible, as they are currently doing, so they can access … So their reports can be finalised, and they can access their stimulus money.

Amy Holdsworth: That in itself is an opportunity if you’re identifying that, because obviously there might be some particular additional advice around cash flow that you can provide to your clients, if you think about it.

Heather Smith: Yeah. Absolutely. For the BAS agents, they’re not normally in a position of dealing with a client and actually getting them money. It’s normally, “Here’s your BAS completed and prepare to pay all this money.” It’s the tax accountant typically that can get money back in, which is just a different mindset for them. What technology tools do you like using, either at work or personally?

Amy Holdsworth: I love Slack.

Heather Smith: Do you?

Amy Holdsworth: I love it. It’s one of my faves. You know what it is? I think the thing I love about it is the gifs and the random emojis. I know that’s like the most childish reason as to why I love using it, but I do. I love it. You know what? Because it provides me with entertainment. It just has a level of dry entertainment associated with it when you put a gif, or anemoji. Anyway, that’s just one thing.

Amy Holdsworth: The other things that I love using in my business are I love using Practice Ignition. I am a massive fan of this software just because I can see the benefits of it. Not only in our own business, but I can see it with the clients. I’m also a lover of Google. I love G Suite. I will say that I use that in my cake business, my little side hustle that I have, only because we, in Clarity Street we actually use Office 365, or now known as Microsoft 365. They have recently rebranded.

Amy Holdsworth: Because all of the platforms realistically connect. Like, all of the platforms that accountants use, and that’s our target market, they use Office 365 essentially, so we use that. That’s what our main platform is, but Google, I love it. I love G Suite, in terms of it’s just easy. It’s just easy to use. FYI Docs, great piece of software as well. It’s also one of my favourites and how I use it. Then, the other things that we also use, I use HubSpot because that actually helps with our client lifecycle at the start of the process. From a lead generation perspective before they become a client.

Amy Holdsworth: Practice Ignition whilst we’re trying to get them to be a client. We manage our workflow, we actually use Xero Practice Manager. Obviously we don’t use the tax component. But just from a workflow perspective. And then FYI Docs, once they are a client obviously, FYI Docs for any other further information and client correspondence and things like that. That’s our main app stack, but yeah, there are a few of the other ones. And Stripe. I’m going to throw in Stripe, just because it makes life so much easier. Add that to your invoices for a payment gateway perspective if you’re not using a platform that takes payment. Add that into your invoices. That’s a quick win.

Heather Smith: Absolutely agree. It can help get the money in quickly. Thank you for sharing those technology tools that you’re using.

Amy, you’re a tantalisingly good baker. You run a business called Red Coat Cake. What are some current trends in the cake world we should be aware of?

Amy Holdsworth: Current trends in the cake world? Naked cakes. Obviously, they’ve had quite a big run. What I mean by a naked cake is, I know that … No, not what you’re thinking. Not what you’re thinking, Heather. It’s called a naked cake style. What that means is instead of having the traditional covered in ganache and then covered in the layer of fondant or ready to roll icing, think wedding cake, think what it looks like with that really smooth outer layer. All they do is they frost it in a cream cheese or a butter cream or something, and they keep it visible so that you can actually see the layer of cake in there as well. The outer feature of the cake is-

Amy Holdsworth: Current trends in the cake world? Naked cakes. Obviously, they’ve had quite a big run. What I mean by a naked cake is, I know that … No, not what you’re thinking. Not what you’re thinking, Heather. It’s called a naked cake style. What that means is instead of having the traditional covered in ganache and then covered in the layer of fondant or ready to roll icing, think wedding cake, think what it looks like with that really smooth outer layer. All they do is they frost it in a cream cheese or a butter cream or something, and they keep it visible so that you can actually see the layer of cake in there as well. The outer feature of the cake is-

Heather Smith: It’s like a peekaboo cake.

Amy Holdsworth: Correct. That’s exactly it. You can still see the layers of cake even though it’s got frosting on the outside. They’re kept quite simple, I think, is the best way of saying it. But they call that the naked-

Heather Smith: Like wearing lingerie.

Amy Holdsworth: I know. They call it the naked cake style.

Heather Smith: I’m shocked, but there I’ve learned something. It does seem to be interesting, a lot of people have a bit of a side business, but I went on your website, and that’s a serious side business you’ve got going there. That must take you quite a big commitment some of those cakes that you’re making.

Amy Holdsworth: They do. I find it quite cathartic, though. I mean, everybody has their own little outlets and the cakes for me, it’s quite cathartic. I love doing wedding cakes. I love symmetry, I just love the elegance of them. Apart from Clarity Street, that’s my zone out, happy space in the kitchen basically.

Heather Smith: That’s wonderful. My daughter’s a procrastibaker. I think I’m a procrastieater. Go well together. Circling back, I just remembered what I was going to mention, how you use G Suite and Microsoft. I actually use both of them simultaneously in my business, which I don’t recommend to a business to do that, but I use them simultaneously because as a consultant, I felt that I needed to know the direction both were going in, because they’re such a major part of the business, and if I arrived there and couldn’t work out something because of the way Microsoft was running, I’d feel like an idiot.

Amy Holdsworth: Yeah. I’ll be honest with you, that’s exactly the reason why I still have a G Suite for one part of my life, and I have Microsoft for the other, because obviously the industry that we service, we need to both more than anything, the pros and cons of dealing with it. The interesting point to note is the better document management solutions out there actually run off a Microsoft based platform. You unfortunately can’t use G Suite with them, so we had to transition to know exactly what is out there and how they obviously operate and work within a firm.

Heather Smith: Yeah, absolutely. Amy, what’s next for you?

Amy Holdsworth: What’s next for me? Another little side hustle that I have … Hang on, are we talking Clarity Street or are we talking just me in general?

Heather Smith: Whatever you want.

Amy Holdsworth: Another little side hustle that I have is although I have cakes, I also do a lot of healthy treats. So, I make protein balls, as well, as a little side hustle. I’m going to be launching Bare Balls very soon, which they’re kind of naked. We started a theme here, Heather.

Heather Smith: You could call them Amazeballs.

Amy Holdsworth: Could call them Amazeballs. I like that. They’re Bare Balls from the perspective of they’re free from any nasties. They’re very healthy, very clean. They’re good for people with intolerances, basically. They’re also really tasty, because some of them you can get, and they taste not so great. They’re dry, but these ones are actually really delicious. That’s going to be my next thing, and I don’t know, one day, one day I’d love just to have a little cake hustle that’s just my little, my shop, and a little cake business. Maybe when I retire one day.

Heather Smith: I think that’s awesome that you have a side hustle, a Bare Balls side hustle, and cake business side hustles which are really quite serious, and-

Amy Holdsworth: They’re a bit of fun.

Heather Smith: You learn from these side hustles as well, and you see where they take you.

Amy Holdsworth: Very much so. Other than that, Clarity Street, world domination obviously. Assisting every firm out there to streamline and make their businesses more efficient.

Heather Smith: Absolutely. Thank you so much, Amy, for being on the show. Is there anything else you’d like to share with our listeners, and how can they get in touch with you?

Amy Holdsworth: I think the last thing that I’d like to share is one of my favourite things to say is you can’t be half pregnant. If you’re going to adopt new software, new processes, new procedures, then damn well do it. Don’t just kind of go halfway through the process and not actually change your mindset and your processes and procedures as well. If you’re going to put in new software, look at everything, look at how it impacts your business, look at how it impacts the operation of your clients and everything, how that’s actually going to roll out before you actually do.

Amy Holdsworth: And then once you have looked at all of that and you’ve decided it’s the right piece of software, adopt it. Make it your baby and make sure that you’ve actually rolled it out and get the most out of that piece of software because time and effort has been invested in that. Sometimes even financial investment has been put in, because you’ve gotten Clarity Street to help you. So use it, basically. You can’t be half pregnant.

Amy Holdsworth: You can get in touch with myself or my business partner, amy@claritystreet.com.au. The website, ClarityStreet.com.au. Otherwise, my business partner, Ian, as well, is ian@claritystreet.com.au. Hit us up, you can find us on LinkedIn, you can find us on Twitter, you can find us on Facebook. That’s where you can find us.

Heather Smith: Excellent. Thank you so much, Amy, for being on the show, and I’ll leave those links in the show notes. Plus I’ll leave links to Red Coat Cakes. I’m sure some people need some cake in their life. I do wonder, you were offering that you were going to transport the cake interstate. How can you transport cakes interstate?

Amy Holdsworth: Look, there’s actually two ways of doing it. I’ve actually transported a cake from Melbourne to Perth without a person taking it. Either I physically take the cake with me onboard, that’s one way, obviously. But the other way is Qantas freight do it, just so you’re aware. You can ship things, yeah, obviously you have to pack it in the right way, but I’ve actually sent cake all over Australia before, depending on what the needs of my clients are. Qantas freight.

Heather Smith: Learning so much from you, Amy. Thank you so much for being on Cloud Stories. Really appreciate your time and all the insight that you shared with our listeners. Thank you so much, Amy.

Amy Holdsworth: Thanks so much, Heather. It’s been lovely.

How is your business navigating the COVID-19 pandemic?

How is your business navigating the COVID-19 pandemic?