“Clients value that. They will pay for that person that’s going to listen and provide… That’s all your clients want, they want it off their plate, and that’s freeing. That gets them focused again on what they need to do, which is their creativity.” – Martha Yasso, Yasso Books

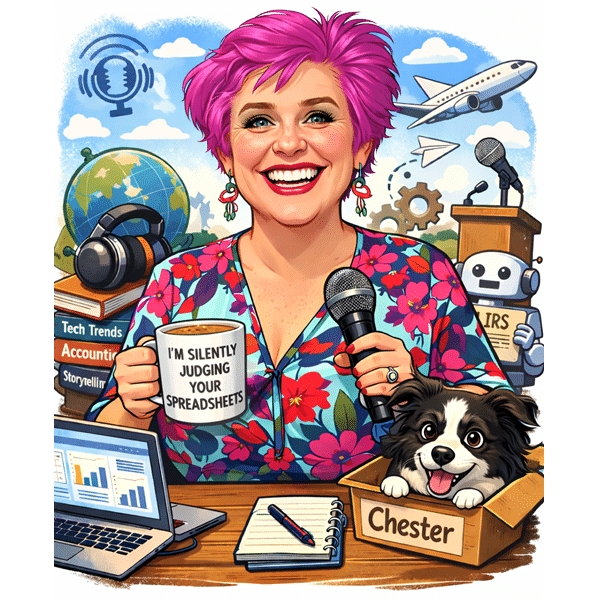

Today I’m speaking with Martha Yasso, Principal of Yasso Books

In this episode, we talk about . . .

- The four points of Cash Flow: Cash In, Cash Out, Cash Balance and Time

- How to avoid the clients glazed over look when unpacking the small business financials

- Conversations to have with clients during these times of a pandemic and uncertainty

- Neural Network, their lack of human emotions and their impact on Accounting Technology used today

- Pricing for Cash Flow Advisory services

- Cash Flow Forecasting Apps Martha likes to use

Can you explain to me and our listeners what a beehive puzzle is?

Martha: Sure. First of all, hello Heather, and thank you for having me on. A beehive puzzle is a letter puzzle. They have them in the New York Times, and there are several Apps that you can download. And the setup looks similar to the honeycomb of a beehive with the individual, I guess almost like all combs. And each one has a letter, and then in the centre, there’s one letter that must be used in each word. The New York times beehive requires that you use a minimum of five letters. And if you use all the letters in the hive, you get three points for that word.

Do you find interesting playing with letters?

Martha: I like puzzles. That’s the commonality there, what’s inside the beehive, how many different combinations can you find? What are the possibilities? That’s what I love that really links my math to puzzles and logic.

Heather: I think that is a key attribute that we perhaps don’t talk about enough, that really sits well or fits well in the advisory piece, the actual puzzle-solving element of it, in that you have various different aspects of it that are similar and it’s like, okay, how do I unpack this? How do I solve this? Well, that’s interesting. I will need to go and have a search for some beehive puzzles and give them a go. I’m not the best letter puzzle person I do like Sudoku, so I’ll try that one.

Can you share with our listeners a bit about your background?

Martha: Sure. Most certainly, my background is not a direct line between education and vocation. I swore that I would not become an accountant or go into accounting whatsoever. I told my family that I would not accept the full ride to Pace University for accounting that I needed to go for economics. And so I followed my passion that way. And my passion for economics was understanding the federal reserve bank of the United States, which got me into learning more about money and money supply. And during an internship in Washington, DC, actual US currency, at one point they were talking about having a domestic currency and an international currency of the dollar.

Heather: Wow.

Martha: Yeah. So, it was very indirect. And then at a point in my life, I took some time off, had kids and my daughter who is turning 10 in two weeks when she was two, I realised I couldn’t decorate the house every year. I needed to keep my mind busy with logic and business rather than doing my house. So I decided because I had been doing my husband’s financial analysis for his business and using QuickBooks for that, that I would explore more this QuickBooks thing, and very exciting at the time, QuickBooks was bringing out QuickBooks online and pretty much free training. So what perfect timing, I took advantage of it, and that was about six years ago now. So, that’s how I ended up getting into Cloud Accounting.

Can you briefly describe the journey to starting Yasso Books?

Martha: Well, if you want me to touch upon my interest in neural networks.

Heather: Yes.

Martha: Okay. So, in addition to the availability of learning QuickBooks online, I had gotten my MBA in banking and finance. And when I did that, my research paper was on neural networks in finance. Now, neural networks, what that is, is the statistical model for understanding, what’s the word I’m looking for? AI, artificial intelligence. And so there are different ways to mathematically model that out. One is by regression analysis and there was this new field of neural networks, and that fascinated me. The term neural literally refers to the brain and the neurons in the brain and connections and exploring the possibility that one point of data could have hundreds and thousands of connections rather than a linear connection of a regression analysis. That was fascinating to me.

Martha: And so, as finance has developed, I could see the possibilities of this power of a neural network within accounting and its ability to, if not forecast, but indicate a direction towards the future. And right now, math can only tell us a certain amount about a person’s emotions. So you can really only probably forecast out about a week with accuracy, but as this capability strengthens, you’ll be able to forecast further and further out into the future.

Are neural networks still relevant today?

Martha: Oh, highly relevant. Neural networks are what underlies artificial intelligence, which is being built into pretty much every app in the QuickBooks realm, and Zero realm that I’ve been made aware of. this is really the future of software teaching itself that a neural network will take the information that it’s learned from a situation, gather that data, and as it moves on to a new situation, it will learn again from point to point. And that’s extremely powerful. So as we move in the future and more of this mathematics and capabilities built into apps and various different software, you’re going to see the ability for accounting to be much more dynamic and robust in the way that we understand and have data points for corporations and small businesses.

Heather: Yeah, absolutely. And so we’re going to become much more predictive, and able to forecast the future.

Martha: Absolutely. And like I said, for right now, the horizon may only be a week or so where you can actually say with certainty, what that prediction might be. And the one thing that a neural network as of yet cannot predict is the human emotion that comes into any economic decision, be it the purchase of a car, or the purchase of, in my case today, a lipstick. It isn’t able to harness that understanding of what you would call human irrationality. Why would you pick a more expensive lipstick just because it’s got a name? So it’s difficult for it to understand that there’s value to something that might have the same exact components, but a different name on it.

Heather: Yeah. That’s very interesting. And one of the things with accountants and bookkeepers are being told is that one of the areas that we need to skill up in is emotional intelligence and empathy. And I guess that’s because we need to partner with the AI, and if they’re not able to do it, we actually need to offer it there. Though I’m assuming that when I write my g-mail, it is using AI to predict the text, and when it comes out and it goes, “I hope you have a nice day” at the end of my letter. I’m always like, yes, because I wouldn’t have said that, because I’d have just currently ended the letter, but no, we’ve got this emotional warmth at the end of the letter, that wasn’t me, but it was me.

Martha: Absolutely. I’m always embracing that.

Heather: So, Martha, we met back in April 2019 back in New York when I was visiting there. And you asked me a question that I was really quite surprised about. The question was, why aren’t Australians upset that they can’t use cash. So to clarify that we’ve moved very much to a cashless society, even back in 2009, you can use cash, but we have moved to a very much cashless society. And you went on to ask me, does a non-cash market disenfranchise the poor, and referencing that in the US most poor do not have bank accounts. So this completely shocked me and I had to go and ask lots of people what the situation was here in Australia. Was I missing something?

Has that situation about a non-cash market disenfranchising the poor changed in the US?

Martha: No. Unfortunately, it has not. There are many hurdles to getting a simple bank account here in the US unless if you are over 18 years of age, many banks require that you have a minimum deposit. And for a large section of our population, they’re unable to keep a bank balance larger than say a thousand dollars of a minimum balance a month. Why? Well, rent, particularly in the New York area is extremely high. Food cost in the New York area, again, very high. And so, it’s hard to be able to open a bank account and sustain that bank account. So many people just skip having that bank account and keep the cash, and just have the cash available in a tin jar in the kitchen, or hidden away.

Martha: These people also don’t use checks many times because they’re not using checks. They have to buy cashiers checks or something like that in order to be able to make larger transactions that would require a check. So, here in the US, we have a lot of check-cashing businesses. So people will get their payroll check, go to this check cashing store and convert it into cash. But of course, this check cashing store will take a percentage as a fee.

Heather: I guess it’s just bizarre how we’ve evolved differently. And that is just very strange to me. Because you really, I guess it was a parameter there, that no one had ever articulated to me before, Oh, this is the issue. And this is why we’re doing this. And this is why we’re doing that. Of course, I imagine, that people in situations that I’m unaware of in Australia who may be facing the same thing, but it was very interesting. And I’m guessing those people in those situations that it’s the same for them.

Are these emerging online banks making it any easier?

Martha: Are they making it easier? I think one of the hardest things to do is probably to start an account with them. Usually, you need some type of bank account or credit card. Many of these people don’t have credit cards. They don’t have that much credit, to begin with. And you can’t use to my knowledge, a debit card to begin to set up one of these online bank accounts. But that is something I would love to look into to see if you can use a debit card to start one of those because that would help the situation.

Heather: It’s very challenging. I read Reddit a lot and I see a lot of people, young people saying, my parents have negatively impacted my credit score. What can I do? And I’m like, this is so bizarre, that there is their attachment there, that this can possibly happen, that they can start behind the eight ball in life. And I know that we’re here talking about accounting and technology, but that is actually a really important part of the flow of how you pay people. It’s like, you’ve got a massive brick wall there in trying to make it easier to pay people and make it easy for people to receive the money and accumulate the money. Because if people are taking cuts of it, every aspect of it, that adds up, unfortunately.

Martha: A little here, a little there, and the percentages start ranging around the 8% level.

Heather: Oh my goodness. It’s for a hopeless situation. That’s not good. So, let’s move back and we’ll move back into the accounting and bookkeeping. Let’s talk about clean data.

What is clean data, why does it matter, and why is this something that you’re obsessed with?

Martha: I am obsessed with clean data because it is key, absolutely key to be able to forecast cash flow. So, cash flow is, it’s my passion. It is my passion. Specifically cash flow for small businesses. The friends that decided to go into business with one another that are making a couple million or less, the families that went into business with one another, for them to understand what cash flow is, kind of blows their mind when you go to speak to them about cash flow, they don’t understand.

How do you explain cash flow to your clients?

Martha: How do I explain cash flow? I try not to, not to my clients, not at all. I don’t use the word, because you have that moment of glaze over. What I would call… do you have Charlie Brown in Australia?

Heather: Yes.

Martha: Okay. The Charlie Brown teacher moment of the wah, wah, wah, wah, wah, wah, definitely, your client zones out and just doesn’t understand. So I don’t use those words. What I try to do when it comes to cash flow is to give my clients an accurate understanding of the cash position of their business. And when I get into cash flow, I could go into so, find detail about the four characteristics that are absolutely necessary to understanding cashflow. But cashflow means nothing in our accounting world. If you do not have clean data.

Martha: Now, to get clean data, and what I mean by clean data is information in your accounting solution, QuickBooks Online, QuickBooks desktop, Zero, that is timely, that is accurate, and that is categorised correctly. All three of these components require time and require an eye to be kept on what’s going on every day with each transaction. And rules are great, rules are wonderful, but you have to stay on top of these transactions and make sure they’re going inaccurately. Because in the computer world, we say garbage in garbage out. So, that’s clean data, put clean information in, keep it up-to-date so that we can get clean cashflow information out for the small businesses.

Martha: And when I talk about cashflow having four points, cashflow is money coming in, money going out, the cash balance and time. I think when we hear presentations, we’re all totalled money coming in money, going out to cash balance. The one thing that never gets highlighted, but is often on the screen is time. When did these three or four points merge? Because that truly is the key to it. When all, when the revenues expenses and cash balance merge, that’s what we’re looking for. And so when I said before that I don’t use the term cash flow to my, clients, because I get that glazed over the face. I understand that finance, talking business and money is so personal here, I don’t know about in Australia, but it’s very, very personal

Heather: It is. It’s a very intimate conversation.

Martha: It is. And so, to put the client at ease, you say something like cashflow and they glaze over. Well, I think you have to acknowledge the emotion that occurs at that point in time. And there are many different emotions. The emotion of not understanding what this accountant or advisor is saying to me, the vocabulary not understanding, or having that moment of fight or flight. Oh, they’re talking to me about something that I don’t understand. Oh, leave now. That’s great. And all emotionally check out. And you don’t want to lose your client that way. You want to be engaged with them. So you need to acknowledge the emotion without saying you acknowledge the emotion.

Heather: And without being patronising, without being condescending in a very empathetic as we were talking about before.

Martha: Absolutely. You must respect them. Your client is doing something absolutely right because they’re killing it in whatever they’re doing. They did not go to school for finance, nor should they, that’s our role as a bookkeeper, accountant, or advisor. We’re the ones that need to know and understand how to manage cashflow. Because you come up to that small business owner and they say, “cash flow, I don’t need that. I have it up here. I have it in my head.” You do. And they do. They’re fabulous at it, they have an innate understanding day to day until they don’t. And that usually comes when there’s a shock in the system, a good shock, which might be that brand new job that you just got that contract, and it’s huge, and it’s going to give you the best year ever. Oh my God, I have to put the expenses out before I get any revenues.

Martha: I didn’t think about that. Okay. How do I handle that? I haven’t had this situation before, and it’s a first time moment. Now, if you have cashflow understanding in place before you get to that first time moment, you’re able to react better. You still have that moment of, Oh my God, I want to run, but then you have your accountant or advisor saying, wait a second. We have a tool in place already. Let’s take a breath. Let’s stop. Let’s breathe. How can we address this great, perfect tool we already have deployed in our understanding of your business? Let’s take advantage of that. And when an advisor looks at that cashflow, don’t say to them, well, your revenue is going to go up. Nope, speak to them about, well, where do you see this contract taking you? What changes do you expect to see?

Martha: And your client will be able to tell you that. They’ll be able to verbalise what they expect in terms of the changes in their daily life. They’ll be able to verbalise that instead of saying, well, I expect my revenues to go up with, no, expect the experiential, get to the experience of what the small business is encountering. And then you, as a bookkeeper and accountant, that’s your job to interpret that and say, based on what you’re saying, this is what I’m seeing the cashflow turning towards. We should think about a short-term instalment loan, or maybe a revolving line of credit, or maybe if you have the opportunity, maybe this is where we go to the small business administration and get a loan to expand into a new area.

Martha: That’s the role of the bookkeeper, accountant, advisor, specifically for small business. And it can be absolutely transformational.

Heather: Yeah, absolutely. Another one, which I’m sure you probably have in the US as well is, if we do have big contracts, there are grant potentials as well to support those.

Martha: Yes.

Heather: Which can make a massive difference. I had one client win a $50,000 grant just out of the blue, it was like, Oh, for, so also being aware of that as well, I think that’s a good thing for the, I think you’ve articulated some good questions that the bookkeeper or accountant advisor should be asking, can ask. And I’m of the opinion that they don’t actually need to have all the answers, but they need to start the conversation. And then maybe, if they realise, if they’ve unpacked the problem, pull people in, who can support them as they see fit.

Martha: Absolutely.

What conversations are you having with your clients looking forward, during these times of pandemic and uncertainty?

Martha: That’s a great question. I know all around the world, with every type of business, the word “pivot” is a keyword in every conversation. And I go back to my MBA training, where I learned about something called core competencies. So for instance, Amazon. Amazon is this huge company. It’s huge. But what is its core competency? Meaning what does it do well that could be applied to any business? They do deliveries.

Heather: I had that.

Martha: They do deliveries. They handle the logistics of the deliveries and they do it better than anybody else. So the conversation with the small businesses that I work with has been, okay, we’re seeing reduced volumes. What else can we pivot our business to on our core competencies? What is it that we do well? Restaurants here, it’s so sad. Living just outside of New York City, there are so many restaurants that are closed. But, there are many restaurants that have done extraordinarily well, because their core competency was preparing meals. How that got served, how that got delivered was different, but their core competency was preparing meals. And those that have focused on preparing those meals and figuring out ways to deliver those meals for some restaurants, with the high quality that they were known for pre-pandemic, that has been a game-changer, an absolute game-changer, but you have to be willing to reinterpret what you do.

Heather: Absolutely.

Martha: And it’s been hard. Some businesses that weren’t able to emotionally address that, some of those businesses are now out of business. Heartbreaking, absolutely heartbreaking. Some people were at a stage in life where they weren’t ready to make changes. Well, it’s so many different reasons. And absolutely every one of them very valid, but it has changed what our downtown’s look like.

Heather: Yeah. Absolutely. Thank you for sharing that. And I think it is just so interesting to see how some people have, but some, I can understand completely exhausted. Like, do I have to, I don’t have the energy in me. What’s the runway looking like? I read this long article on Reddit yesterday, and this lady posted in saying when this all happened, I lost my job and I thought, well, I can ride. So I went on Fiverr. And I offered myself up at $5 and then I went to $40 and I’m now I’m charging $400, and then I’m taking those clients and I’m now working with them individually rather than via Fiverr. And I am going to take out the premises and I’m going to employ more people and start my own copywriting agency. And that’s sort of in the matter of a, I guess a year, but what was really nice about it was she just, she went through every aspect of it. And how she actually did that transformational transition as you talk about. Some people identifying that the core element is important.

Martha: It is. And it’s there. Everybody has that core element. And for some, it’s harder to find, but find somebody to talk it out with you. I think I have spent a lot of time. Yes, no, maybe that’s the wrong way to describe it, but I do spend time with my clients talking about what they do, and what their passion is. And for right now, or pre-pandemic, it looked like one thing. For now, it could look totally different. But as you say, finding a writing career, how exciting is that?

Heather: Absolutely.

Martha: And doing even better than she did before. I mean, what a blessing, that’s really finding a passion and running with it.

Heather: Yeah, absolutely. And I think what you’re saying, it is so true in that, bookkeepers are in such a brilliant position to actually have those conversations because they actually know the business intimately. They know that business owner almost intimately in a financial sense, and they can start having those conversations. So it’s very much something that I encourage. And while, we’re going to come in and we’re going to put inefficiencies and workflows and maybe do we dig in to do compliance, having unpacking, peeling back those conversations and having those conversations, we are well-positioned to do that.

What steps would you suggest that accountants and bookkeepers need to take to move into having discussions, or offering cash flow analysis and forecasting management to their clients?

Martha: That is a fabulous question. I think every accountant and bookkeeper already has the skills to do cashflow analysis. If you can read a cash flow statement, you certainly have the skills already. An app is a visualisation of that cashflow statement, the statement being past tense. So to move into advisory, the step is moving into the business owners experience. Understanding what they experience, stay in the language of experience. That is key. The rest of it is technical, you already know it. You know it, it’s there. Don’t say ever to a client, let’s talk about your cash flow. No, let’s talk about your business. Let’s talk about what you want to do. What’s been bothering you recently, what hasn’t been working.

Martha: And I think we’ve heard these questions over the years, and Lord knows I’ve heard them at every conference I have been to, but I think what needs to be done is to ask those questions with the understanding of experience. And when you ask what the experience is, what are you seeing? Heather, how has your business changed? Is there something that you’re uncomfortable with, or something you want to talk to me about? And then don’t speak, listen. Absolutely, do not speak, listen, take notes. And then because you are the accountant, you understand compliance, interpret those dreams, those fears, those emotions into words, into financial movement, and do the work that you’re supposed to be doing for your client for them.

Martha: And you went to school for this. This is what you should be doing. Be that person that they can say, thank you for talking to me. I mean, I can say here in the US, there’s been a big change with CPAs and accountants or what I call small business accountants and bookkeepers, as opposed to CPAs. I’ve had four clients this year, brand new clients, since the pandemic say to me, “How come my CPA doesn’t talk to me?” I say, “Well, there’s been a change where it CPAs really focus on taxes more than anything else.” And they said, “Well, why they’re supposed to help me with my business?” And I said, “well, you need to speak to them about that. And if you’re not getting an answer, you’re in the wrong place, you have the wrong accountant.”

Martha: And there are so many small businesses that need the accountant that’s going to talk to them, that’s going to listen to them. Yes, the taxes are important, well, let the CPA do that. That’s what they do well. If you are a small business accountant, you understand the small business well. Embrace that, really let yourself internalise it, and be there for the client. These four clients have all said, thank you for listening to me. The first couple of times that they said that, I was shocked. Why would they not be listened to? Who is not listening? And that’s where the opportunity is here.

Martha: And for me, the opportunity, I don’t think of it in financial terms. I think in terms of supporting communities, supporting your neighbours, supporting the small and local economies, which here in the United States is the largest part of our economy. The small businesses, help the small businesses and you’re going to help the entire nation.

Heather: Absolutely. It has a massive ripple effect across the small businesses. And I know listeners will know that my own accountant, we typically for our meeting, it’s an hour at like a cafe or a restaurant with not a piece of paper insight, not a number insight. It’s just an open discussion about things. And he’s a fabulous accountant because he can always, it’s like, he puts a fishing reel out, and find something and then pulls that out, and then we go from there. And it’s always beneficial. And it’s difficult to get some funds for that position.

Martha: I’d love to ask you one quick question. How do you feel after that meeting?

Heather: Oh, I love my accountant.

Martha: Do you feel like you’ve shared something and learn something?

Heather: Oh, yes. Yeah. I always know that a meeting with my accountant is going to turbocharge me and just step me up. Sometimes I don’t have the capacity for it, so I’m like, let’s pull back, but we’ll just like put the plans in place for then that next meeting where it’s then, let’s step up to that next level and let’s do this, and let’s focus on this. Yeah, so he’s an integral part of my business and knows us inside out, upside down. Anything, changes that happen, we’ll shoot him through a message saying this has happened, this has happened. And then he’ll just ring up. You need to come for lunch. You’re like, great, that’s whatever.

Heather: And it’s like, just charge us whatever you need to charge us. And it’s funny because that’s the question I’m going to come on to because I’m like send the invoice, I just pay it. I don’t even care because I know how much benefit I get from that. But I am going to ask you, so for the people out there who are looking to move in towards offering this, many times they struggle with offering a new service, and how they go about pricing it.

How do you navigate the pricing of offering this advice, and what advice do you have for them?

Martha: So, years ago, in the very beginning I did the per-hour fees, and I got away from that and I started doing monthly fees and I did it poorly. I did not value myself and as I grew and actually I explored more about cash flow, I really began to understand that I needed to value myself. And I thought, okay, well I’m getting up my monthly ends if they say no, then I know I’ve hit a line and maybe I need to pull back. Heather, I haven’t hit that line yet.

Martha: And very honestly, one day I was sitting there ready to have a conversation about monthly fees. I looked at the way I had priced it and I thought, I’m going to add another thousand dollars a month to this. And I thought myself crazy. The client didn’t even blink an eye.

Martha: So, obviously, the client saw that value. It’s a matter of trusting myself and that gets into imposter syndrome and things like that. But, you know it. And I want to tell you that the accountants and bookkeepers, know it.

Heather: It’s almost a relief that you charge me. Just charge me, because I want the top class advice. I want the best advice, just charge me for it. And it is unusual out there. And I sometimes see people who just hit the market and have no experience and are charging them high prices et cetera. But I do see a lot of people out there who I think should be charging a lot more than they are. And I know that some of my friends hate me because I’m always harassing them saying, “Put your prices up, put your prices up.”

Martha: My colleagues did that, and it really was transformational for me. And I think if anything if you’re going from compliance to the advisory, your clients, there is such a hole in the markets for the advisory of listening to your client. And they value that, and they will pay for that person that’s going to listen and provide, not always the answer because many times you don’t have the answer, but I will sit with a client say, you know what? I’ve got no clue, but I have three other people that I know that have dealt with this before, give me two days. And then let’s set a time for Thursday and talk about what I found out, and we’ll take it from there. That’s all your clients want, they want it off their plate, and that’s freeing. That gets them focused again on what they need to do, which is their creativity.

Heather: Yeah. Absolutely, focus on their business, their life, et cetera, while they can work through that with you. So, that’s sensational. Thank you for sharing that with us.

What cashflow forecasting apps do you like working with Martha?

Martha: QuickBooks is building out the cashflow tool that they have in it right now. They began with something that went live approximately a year ago, and I was very excited about this, that it was actually available in the product. That said, it’s not necessarily the right tool for everybody. I think, number one, I specialise in small business cashflow applications. So there are many applications out there that say their cash flow, and they also say that they do KPIs. Those apps are meant for medium to large-sized businesses. I’m going to say that again, those that focus on cash flow and KPIs are meant for medium to large size businesses. And they’re fabulous for that segment. But for the small business owner, you need something that truly focuses on cashflow. Cashflow is no more than 12 months, no more. It’s more like nine months.

Martha: And for many businesses, it might be 60 days or less. So, that’s what cash flow is. So, the apps that we have, I have a couple that I absolutely love. The field is changing day by day. I was on a web conference last week, hosted out of London that provided a whole bunch of international apps that I wish the functionality worked in the US. So please, please, please. You have to please work on that.

Martha: Just for a few of the apps, one of my favourites is cashflow tool, which is by Finagraph. They have the great capability at bringing in data and you’re being able to manipulate that data in terms of, down to the transaction. Now, that might be too much for some businesses, they may say, well, I can’t handle it. One transaction at a time, no, I need something grouped differently. In which case, Dryrun, great app, absolutely a great app. And you’re able to see presentations of timing and revenues in different ways on that app. They’re also great at forecasting and putting in a quick forecast, it’s got that capability.

Martha: And then there’s an amazing app called Helm, that in the US not only can you see cashflow and it presents it differently than other apps. Other apps usually do, like a flat line and then two bars of expenses and revenues. Helm actually takes the expenses and they go down with that bar instead of being next to the revenue. But you can actually click on each bar and move individual expenses to a different time. I love it. It’s so much fun. It’s fun to click on. and even better, they just teamed up with Veem, you can pay your expenses in app. I love that.

Martha: Which means as you sit there and you’re looking at your cashflow, you can decide, I wait on this bill, but I pay this one now, boom done. You don’t have to go out back into QuickBooks or whatever AP you’re using, you just do it right there. There are a whole bunch of others. I think a lot of people talk about giraffe, and giraffe is an amazing app, but it’s meant for large businesses. Don’t be thinking small businesses with that. Just know. Believe me, I look forward to the days when I see my small business businesses growing, and I say, guess what? It’s time to move you to giraffe. So that’s an exciting moment for me. There are, I think there are about 20 apps that I have been looking at and I could go into each and every one, how much time do you have?

Heather: I don’t want to take all of your time. Maybe we have another session. You can go through all of them in one go.

Martha: Absolutely. And I know this person doesn’t know that I’m going to do this, but I will say that, if you want to understand cashflow, there is one person that you absolutely need to listen to, and that’s Jeanie Whitehouse. She is absolutely phenomenal. Listened to… she’s coming up with podcasts now. So I’m excited to hear that. And, Oh my goodness, there’s a brand new cashflow app coming out by Mike Malem, and Simplex and it’s called Path and it combines a… it’s like a Slack area along with graphics area and what they call the mashup.

Heather: Sounds like a millennial cashflow solution.

Martha: Yes, it is. It’s like a millennials app. But it uses AI, the neural network and AI to pull information out of that Slack-like area, and bring that information into its calculations. Things like, Oh, well, I’m not going to be in on Friday. Well now, the app can take the information and say, Oh, let’s adjust production. The future is here. It’s awesome.

Heather: Yeah.

Martha: It’s all happening.

Heather: It is. It’s very exciting. There’s a lot of exciting opportunities out there, and there are accountants and bookkeepers, we can significantly help our businesses understand this and make better decisions with this information.

Heather: So really enjoyed having you on the show, Martha, and we’re going on a bit long now, so I will trim it a bit, but I would like to just quickly ask you, and we will get you back and we’ll do the 20 apps in 20 minutes, 20 cashflow apps in 20 minutes.

Martha: Speed apps.

Heather: Speed app dating. No, maybe we’ll allow you 40 minutes for that. What is next for you?

Martha: What is next for me?

What does 2021 hold for you? What are you looking forward to?

Martha: Growth. And right now I have two roads that I am putting together and beginning to get it to gel a little bit. I look forward to sharing my ideas with other people. I really want to get out a little bit more and be able to talk to people and get past that hump of what cash flow is.

Martha: And I know we covered a lot of it today, but one thing that I also realised is there are so many different definitions of cashflow. So, if I do one thing this year, is to educate people on what cashflow really is, and we get a common definition. If I can get a common definition out there, and a point of reference for everybody to work from, this will be the best year ever.

Do you want to share your common definition with me?

Martha: Well, my common definition actually goes back to the four points.

Heather: That’s good.

Martha: That the revenues, the expenses, the cash balance and time. And that cash flow is no more than 12 months long. There a banking definition, there’s an accounting definition, there’s a financial investment definition. And as a community, we’re working with all these different understandings. Let’s get back down to the simple one, four parts, 12 months, that’s it.

Heather: Yeah, it makes a lot of sense. And I think that the time element wraps it all up to really surface what you’re talking about here. Thank you so much, Martha, for joining me on the Cloud Stories Podcast, our first one back for 2021. So that’s very exciting.

Is there anything else you’d like to share with our listeners? And how can they get in touch with you?

Martha: Well, they can always reach me at my website. That’s, www.yassobooks.com, and looking forward to the future. I think those things right now aren’t quite as bleak as they used to be. Let’s look towards the bright side, let’s see the possibilities in what we have because there are lots of possibilities. And so the way we go about life has changed, but there’s so much good out there that we can do. Let’s find it, let’s make it even better. And it will, it will be better. And we’re going to have to learn how to socialise differently, but let’s still be social. Let’s still care about one another. You can still pick up that phone. You can still text somebody, a connection is the most important thing, be it in community or finance or accounting or small business. It’s all about connection and experience.

Heather: Yeah, absolutely. Thank you so much, Martha. And the funny thing is, while we connected in real life, we have connected a number of times online, which has been one of the benefits of this unusual situation.

Martha: I do miss you.

Heather: I was supposed to… I was almost there, and then all of this erupted, but hopefully, I’ll get there again sometime soon. Thank you so much-

Martha: Hopefully, maybe I can now head over to Australia?

Heather: Absolutely. I think there’ll be an influx of people coming to Australia. So thank you so much for being on the Cloud Stories Podcast, really enjoyed having you here and hopefully our listeners can get in touch with you and I look forward to speaking to you again, Martha.

Martha: Thank you, Heather.