On Friday 31st January, I attended Brisbane MYOB Incite 2020. The first stop of MYOB’s national roadshow and first time we’d hear from the MYOB’s new CEO, Greg Ellis.

I have included a snippet of Mr Ellis’s talk in the accompanying video and shall focus my commentary to the apps marketplace.

With a rapidly growing ecosystem, MYOB has evolved their API strategy, though the strategies differ from Practice to SME’s. Within MYOB Practice (from a Practice Management, Tax, Compliance, and Advisory) standpoint, MYOB will undertake deep integrations with best of breed service providers. They’ll lean towards building deeper more robust integrations with solutions currently used by the majority of practices.

There was also commentary that MYOB shall open up further their API access, in layman’s terms, this means more data can sync with vendor solution for SME solutions – which is great news!

There were five (yes – just five) accounting Apps at the MYOB marketplace; Fee Synergy, Fathom, ServiceM8, Tanda and Ostendo, and they were allowed only two branded representatives. Notably, there was not a receipt scanning solution as part of their marketplace mix. Does this indicate that MYOB hopes to build out a full functioning receipt scanning solution – it currently has MYOB Capture app – for capturing receipts by photograph.

The keynote speaker was Catriona Wallace. I first heard her speak at Xerocon a short four months ago. She talked through key Social, Organisational and Customer Experience trends.

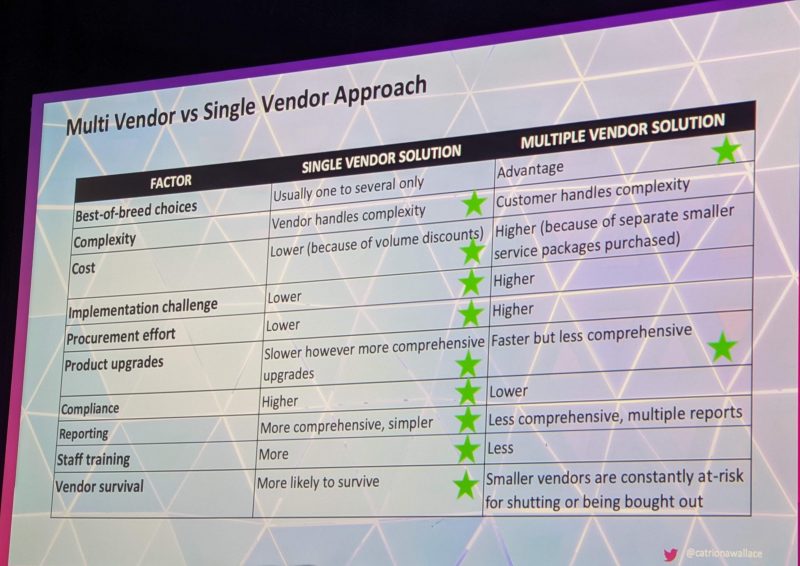

Dr Wallace expressed her concerns about a large ecosystem, it is a trend that she said we are not mature enough to manage. Then Dr Wallace facilitated role play discussion on the stage that worked through Multi Vendor vs Single Vendor Approach. A tech stack vs a single solution.

This is the slide from the presentation. The slide headings and the column headings don’t align, so don’t get confused when you’re interpreting the slide.

The factors are not in alphabetical order, this would suggest they are ranked in order of importance.

I don’t know what the supporting empirical evidence is to develop this chart. We were probably told, but I did not make a note of it. I don’t know who was surveyed, and what circumstances were under review to come up with the green star rating.

I can comment on this chart from my experience in the Accounting and Bookkeeping community, noting I’m both a professionally qualified accountant, and bookkeeper, am a certified cloud integrator, have been involved with many integrations and technology conversations in the global micro to small business community for close to a decade. I sit comfortably in the smaller end of town, with extensive knowledge of the current business technology ecosystem. Also, I have a significant number of apps currently doing the heavy lifting in my business – so I embrace technology.

Best-of-breed choices

Agree. Multiple options gives you the best of features available in the market.

Complexity, Implementation challenge and Procurement effort

Yes. These factors can all be simpler with a single solution. The rise of the Cloud Integrator, the recent launch of Chartered Accountants Automation in Practice Management playbook, the interest in Accounting Technology across the world, is in part due to the complexity in this area. If these are concerns, refer to an expert (or even leverage the opportunity to evolve to be the expert).

I’ll point out that any single vendor solution that’s still connected to a server operation, can be challenging and for some requires access to IT experts. I know I frequently have to defer to the IT experts when dealing with AccountRight Live homed on servers.

I’d spend a lot of time educating the community about Accounting Apps – I suggest you sign up to my newsletter if you’ve not already done so if you want to self help your learning in this area.

Cost

Many case studies I’ve seen regarding multiple vendor solutions have seen overall a significant cost decline. But simply comparing subscription cost to subscription costs is limiting in this comparison. Cost savings can be recognised in the reduction of manual processing, server costs, rental space, unnecessary hardware insurance etc. On a case by case scenario sure there will be some better off here. But for me, I am happy to pay for anything I can automate so that I can use my brain power and resources elsewhere.

Product upgrades

Online upgrades are fast and furious. Single focused solutions have far more resources specifically available for developing new features and deeper product functionality. If you are using an app and it is not keeping up with the competitors’ releases, it’s like a piece of lego; you can unplug and replug in. Unpacking that, if a job feature is a nice to have but not critical, use the feature inbuilt in the software, if jobs is critical for your business operations, look to an app, such as ServiceM8, that will offer far more feature-rich solution.

Compliance

The Australian Business Software Industry Association, of which MYOB is a member of, has developed a Security Standard for Add-on Marketplaces (SSAM).

Essentially it outlines a consistent set of rules, specifications and practices for both DSPs and third party developers who integrate with cloud based taxation, superannuation, payroll or accounting software via API.

The security requirements specified in the SSAM were modelled closely on Intuit’s QBO App Store guidelines. If an app is currently certified by Intuit, then it will probably meet the SSAM requirements already.

If an App is certified by, say Intuit, for security purposes, it should also pass Xero requirements, and vice versa. I would assume the same certification levels would apply to MYOB. Higher level of security and trust, while streamlining and standardising the process.

You can read more about it here: https://www.absia.asn.au/ So yes I would not use an app unless it has been certified, but it could be certified by any of the reputable accounting solutions, and I would have confidence in its security and compliance.

Reporting

MYOB has great inbuilt reports – but I’d be using one of the multiple vendor solutions to achieve enhanced reporting. Fathom who were exhibiting on the day, offer analysis, reports, benchmarks, consolidations and alerts, and if you really want to pop the data analytics and visualisation you would look to a solution like Microsoft Power BI. In terms of reporting, multiple vendor solutions offer comprehensive holistic reporting.

Staff Training

Agree training is probably easier on a single solution, and the solution should have the same look and feel throughout, making growth and working in different areas easier. Though, saying that. For operational solutions, say ServiceM8, I want the tradies on the road, to be in the job tracking solution, and not to access the core accounting functionality. So to an extent it comes down to the ability to segment the solution, by the users required access.

Vendor Survival

I’ll let you google the MYOB and Mamut story, it is my go to story of Vendors suddenly not being available. It is a good case for not being too reliant on one solution. Yes, there has been mergers and acquisitions and vendors that have slipped off the horizon. In most cases, they develop a suitable exit strategy path for existing client base.

In summary

The chart feels biased towards a single vendor solution. If the single vendor solution is the best of breed – then great. I think many of the points could be argued each way. Many Apps can support multiple GL solutions, and I’m recognising that the accounting solution is not the critical factor for many small businesses, it’s the operational apps that sit around it and connect into it that are. Competition is good for the industry; it pushes all solutions to be better. We and our clients are the winners.

Like a set menu, minimising choice, certainly simplified the offerings and decisions. I spoke with several different people on the day, and there was a common remark that attendees were overwhelmed by technology. Certainly, there is a lot of commentary generally within the industry about app overwhelm. Dr Wallace shared with us the term:

TerriCited – terrified and excited of AI and emerging tech trends.

You’re clearly interested in Accounting Apps and I suggest you sign up to my newsletter here.

MYOB Essentials

With respect to product – I don’t feel equipped to provide too much commentary here – however I did see a demo of the new look MYOB Essentials.

It was clean & user friendly.

It was mobile accessible.

It will include a powerful payroll model.

Plus they are opening up the API’s to enable connections & data extraction.

Historically data could not be extracted from MYOB Essentials, barely anything of interest could connect to it, nor was there an upgrade path. Apart from being cheap and cloud based, it had very little going for it. Now MYOB Essentials looks like it could be a serious contender as a cloud accounting solution.