“One way to think of Translucent is a bit like a data warehouse. We’re trying to give our users a single source of truth and break down the walls. They might be using five Xeros or 50 Xeros. It doesn’t matter. They’ve got one set of data, one warehouse of data. Everything in one place”.

– Michael Wood, Founder and CEO at Translucent

Scroll down for a full transcript

Michael Wood truly lives and breathes the title of entrepreneur. Currently, he’s the Founder & CEO of Translucent. His LinkedIn profile reveals he’s also the founder of 4 other companies. The company that you’re likely to know him from is Receipt Bank. Michael was the original co-founder and was there till April 2021, when it was acquired by private equity group HgCapital.

Please be aware I strategically partner with Translucent. I was an early adopter of Receipt Bank and an early adopter of Translucent. I’m sure you will find this interview enlightening!

In this episode, we talk about . . .

- Michael’s journey from pursuing a Bachelor of Science in zoology to founding a marketing and growth consultancy firm, Tweed London.

- The origins and evolution of Receipt Bank, a digital receipt management platform.

- The impact of Xero’s API on the accounting industry.

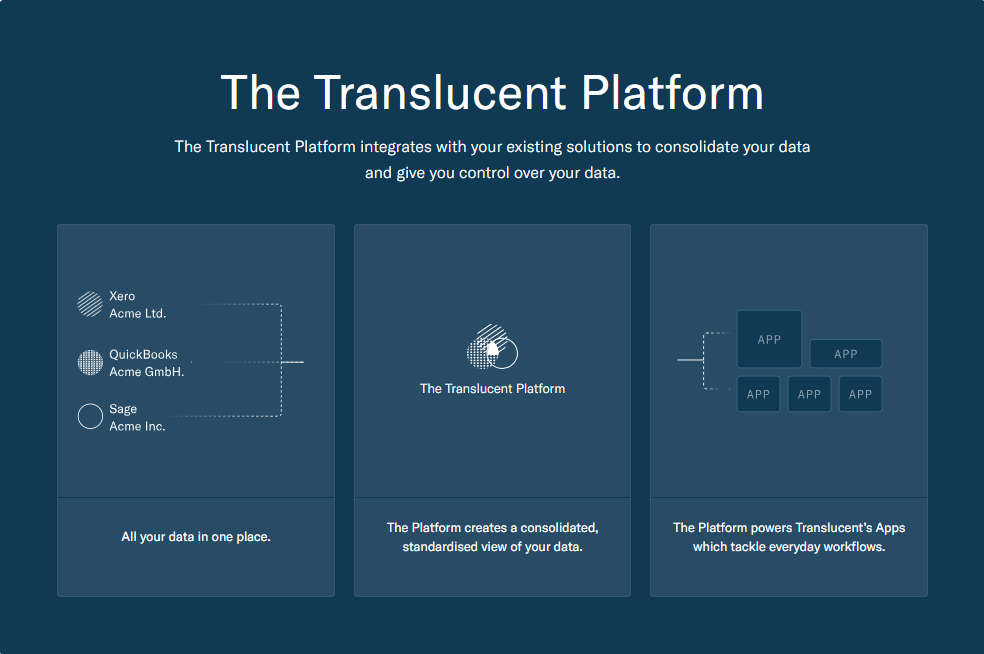

- Michael discusses how his experience at Receipt Bank led to the launch of Translucent, a solution for multi-entity businesses to manage their accounting setup.

- How Translucent is using a compound startup approach to build multiple apps within one platform, aiming to launch four apps per year.

- Michael explains that Translucent is like a data warehouse, providing a single source of truth for users to easily search and find data across all their entities.

- Michael discusses upcoming features for their financial management platform, including bank consolidation and intercompany loans.

- The future of accounting, globalisation, and the need for a more unified toolset.

- Michael shares his views on the future of the accounting and technology industry through 2030, emphasising the value of data and its journey towards maximisation.

- Michael highlights the increasing importance of data in the industry, and how firms and finance departments will need to surf the technology wave to keep up.

Michael Wood: https://www.linkedin.com/in/michaelwood/

Translucent: https://translucent.app/

Summary

- Career paths, Zoology degree, and entrepreneurship

- Michael Wood shares his journey from pursuing a Bachelor of Science in zoology to founding a marketing and growth consultancy firm, Tweed London.

- Wood’s interest in zoology was sparked by his love for whales and dolphins, but he eventually realized he didn’t want to spend his life working in a zoo.

- Founding Receipt Bank and Cloud Accounting

- Michael Wood co-founded Receipt Bank in 2010, building on his experience with Cloud Accounting software (K) he had been using for three years.

- Time-consuming and error-prone process of data entry for his receipts and invoices, leading him to seek a solution.

- The origins and evolution of Receipt Bank, a digital receipt management platform

- The early days of MYOB and Receipt Bank.

- How Receipt Bank changed its name from “Farm” to “Bank” to convey a sense of security and stability, particularly in light of concerns about Cloud security in 2010.

- Michael Wood credits Xero’s API team for the success of their partnership with Xero.

- The impact of Xero’s API on the accounting industry

- Xero’s advanced API, was a game-changer in the market, making it easier to integrate with other platforms.

- Accounting and financial management insights

- How Receipt Bank expanded globally, leading to the need for a more robust accounting system, and how Translucent addresses these issues with its platform.

- Multi-entity accounting challenges led to the launching of a one-stop solution.

- Using software to streamline workflows and reduce costs

- Translucent uses a compound startup approach to build multiple apps within one platform, launching four apps per year.

- The unbundling era in Silicon Valley from 2010 to 2020 led to an explosion of new companies.

- Rippling, a company started in the US, is an example of a company that is bringing the concept of bundling multiple workflows into one place to the accountancy and finance industry.

- Translucent’s data consolidation and search functionality for multi-entity businesses

- Translucent is like a data warehouse, providing a single source of truth for users to easily search and find data across all their entities.

- The capabilities of Translucent’s group reporting feature, which can handle more than 200 entities and provide detailed drill-downs to individual transactions.

- Wood highlights the technology behind the feature, including the ability to click through to Xero files and see the actual transactions that make up a consolidated report.

- Multi-entity accounting software and integrations

- Upcoming features for their financial management platform, including bank consolidation and intercompany loans.

- Wood shares that the next app to be released will be bank consolidation, allowing users to view their cash position across all entities and currencies in one place.

- Translucent’s app development and integration efforts, with a focus on connecting systems globally.

- Global accounting challenges and a new platform to address them

- Globalization and the need for a more unified toolset.

- Translucent’s multicurrency alignment and impressive list of backers, including well-known industry figures.

- The future of accounting technology with industry expert Michael Wood

- The future of the accounting and technology industry through 2030, emphasizing the value of data and its journey towards maximization.

- AI-powered procurement benchmarks will increase transparency in the future of data sharing.

- The increasing importance of data in the industry, and how firms and finance departments will need to surf the technology wave to keep up.

- Accounting and business with a podcast host and guest

- The origin story of Receipt Bank, with Heather expressing curiosity about the investors’ educational backgrounds.

- About always learning and staying up-to-date on accounting matters.

Heather: Hello, Michael, welcome to the Cloud Stories podcast, really excited to have you here. So in preparing for this interview, I’ve been trawling through photos of the Aberdeen Zoology Museum. There’s a photo of a very mankey taxidermied koala in that museum. That’s not what koalas are. Within four years of graduating, with a Bachelor of Science in zoology, you’d co founded Cocojambo which almost bankrupt you. You then seven years after graduating founded Tweed London, helping companies with marketing and growth.

Why did you choose to do a bachelor of science in zoology? What’s your favourite uniquely Scottish animal?

Michael

Lots in there, Heather. And so I don’t remember the koala. That thing we always laughed at in that museum was the hedgehog. So the hedgehog had been taxidermied like a hedgehog is this violence or urn preacher. It was so hilarious, this sort of edge dog. It’s something you have to jump out the way of. So I was absolutely convinced in my teenage years I was going to be a zoologists. Always really enjoyed science, it was always my strength. Hugely interested in whales and dolphins, particularly orcas. And so you know, that was just super interested. I was going to do it. There was probably a bit of naivete there. My parents went to university in a generation where it didn’t matter what degree you did just by getting a degree. You know, you were locked and loaded onto you know, a good career path. So they were very relaxed about me doing a degree like that. And it was a real shock for me when finishing the degree and having made the decision. I said don’t want to do zoology to find out, you know, employers were, you know, what the hell’s this? You know. Because I very much been brought up to believe Oh, it doesn’t matter what what degree you do, you know, just the fact that you’ve got a degree under your belt, it’ll be you good. So it was it was tremendously difficult to get that first job like really really tough. And but yeah, I halfway through the degree, it was like, an itch that got strapped scratched and intellectual itch. But sort of three years into the four year degree. I was like, oh, you know what, I’ve learned tons about zoology but I don’t want to do this for the rest of my life. And my dad was a management consultant. And so I’d sort of grown up with copies of things at the Harvard Business Review lying around and stuff like that. So there there had always been that as another interest. So I sort of switched from one interest to another.

Heather

And listening to that. I remember I interviewed Sophie, who was your third employee, and she was a grad in English literature. I always wondered, how you employ an English literature grad to do the phenomenal job that Sophie did, but maybe it was your openness to having a zoology degree that made you go: Yeah, I can. Sophie can do this.

Michael

That’s probably is true. I must admit, I’m completely blind, pretty much to what degree someone has done. I’m interested in the institution. I’m interested in sort of how they did. But I’m very blind to what they did. Yeah.

And your favourite uniquely Scottish animal is…

Michael

Uniquely Scottish?

Heather

They actually list dolphins and you said dolphins, because the Moray Firth near Aberdeen is known for a population of bottlenose dolphins.

Michael

It is and I went I went up to study them for a week or so.

Heather

Is that your favorite? You can name another if you wish to.

Michael

Well, that trip is where I met one of my first girlfriends. So I don’t remember the dolphins quite as much. You can’t definitely go bottlenose dolphins as uniquely Scottish. I’m trying to think what is uniquely Scottish.

Heather

Because this was my thing, I thought zoology in Scotland, what is there in Scotland?.

Michael

Everyone’s sort of going off around the world and things like that. Uniquely Scotland’s? Scotland’s got some fairly cool mammals but the population of the deer are amazing. You have got things like pine Martens and sort of time again and all those kinds of things. But not uniquely Scottish, but I did fish a lot salmon. Oh, yeah. Something pretty amazing about wild salmon. So I’m gonna go salmon.

Heather

It said Atlantic salmon in the rivers of Aberdeen shear is famous in the River Dee and the River Don.

Michael

Exactly.

Heather

We now have pictures of you doing a who is a Brad Pitt and doing that fly fishing in those rivers.

Michael

Fishing is what I did. But I would be very, very nervous of comparing my look to Brad Pitt.

Heather

Well, we have everyone out there thinking that way. So Michael, so then we come to 2010, 13 years ago, Bruno Mars was singing Just the way you are.

Back in 2010, you –along with Alexis Prenn– co-founded Receipt Bank. Can you share the story of founding Receipt Bank?

Michael

Sure. So it came about in a way I think many of your listeners will be familiar of and that was in our previous business Tweed. I decided in 2006 2007 to do my own books, and I wanted to save some money. And in the UK at the time MYOB was the one marketing itself as the sort of easiest to use most business owner friendly package. Obviously, it’s the DVDs. I ordered the DVD, got the DVD sort of did a year of my books. And at the end of the year, you know, went to my accountant, and she was very nice about it. And she said, Well, Michael normally, the year end fee would be 2000 pounds. But you’ve made such a mess of your books. It’s going to be a carnivals three or 4000 pounds. There’s basically doubled you know, you’ve made such a mess. Other than do all this, you know, we’re gonna have to charge you double. So that was a bit dispiriting. But she said, look, here’s something that you even you won’t be able to mock up. And she introduced me to an online piece of software called Kashflow, spelled K. So K-A-S-H. And unbeknownst to me, that was the first cloud accounting package in the UK. This is 2007. So it was also on the first cloud accounting packages around the world. And so the complete serendipity of Receipt Bank was I was one of the first cloud accounting users anywhere in the world. And so I use it for three years and got to 2010. The point which you mentioned, and by then, I had got a bit fed up with cloud accounting. So in some ways, I love the benefits. And there were a huge number of benefits but the bit I got fed up with is of course when you’re back in the day of talking about a file, whether it be a sage file, an MOV file, a QuickBooks file, whoever had the file, was responsible for the bookkeeping and hence had to do all the data entry of the receipts, the invoices, etc. And what tends to happen between myself my accountant and the fact this was in the cloud, is it become ambiguous who was doing the bookkeeping? And because I was someone who was always late, it ended up being me. And so I ended up losing both a ton of time at the year end suddenly having to do all this data entry into my cloud accounting package. But I was also losing a ton of money because because I didn’t have a regular process it was at that year end with no time before deadline. I was having to you know, I’m sure you know, where’s I definitely got a flight. Where’s the receipt for that? Or I know I got more taxes than this. So I in 2010, I absolutely felt you know, cloud accounting is the future. But also, there has to be a solution for this data entry paperwork to cloud workflow, because it doesn’t work. And that’s when I started looking around for something in 2010 and I came across a business called Receipt Farm and Receipt Farm said we will give you an envelope. We’ll post you an envelope once a month. You put your receipts and invoices in it and post it back. We will do the data entry and it’ll be available for you in a cloud. I think they might have called a Cloud Vault or something like that at the time. And I was like this is great. This is exactly what I need. So signed up for the free trial. They sent me an envelope I put my receipts in the envelope I sent them back. Sure enough, I got an email four days later saying please log in logged in there. They all were scanned data extracted, and I was like, this is brilliant. But I wrote back to them saying, you know, the issues is once I put my envelope in the post, I think I’m done. You know, I think that’s now my accountants responsibility or my bookkeepers responsibility. So two questions, where are you going to create the ability for my accountant to log in to my Receipt Farm account? And are you going to integrate with the cloud accounting packages so the data flows from Receipt Farm to the accounting package? And they wrote back saying, Mr. Woods we’re closing down today. And so I wrote back saying, Well, can I buy it? And that’s how Receipt Bank started.

Heather

I didn’t know any of that. That’s a fascinating, interesting tidbit in there, which you perhaps know was Wayne Schmidt brought MYOB to the UK.

Michael

Did he? I didn’t know he was the he was the man that brought okay.

Heather

Yeah, he did bring him MYOB to the UK. That was fascinating. Oh, you had the same because I remember the early days of Roger, are you talking about Xero because I was sitting with the MYOB file and I was sitting doing the data entry. And I just absorbed the frustration. Whereas watching Rod Drury for the first time talk, he had all that frustration. I was like, chill him. But again, it’s a time thing with you I hear the frustration and you come up with a solution rather than they just absorbs it and deals with it.

Michael

There’s a great Bill Gates quote about something like always employ lazy people because lazy people will always find the shortcut to you know the problem and dealing with the frustration.

Heather

Yeah, and it’s funny because every so often you deal with someone from which is now DEXT and they have the email address farming. They don’t have the Receipt Bank address. Like only very few people but I’ve just seen every so often I see it. So that’s funny.

How did you evolve from Receipt Farm to the name Receipt Bank?

Michael

So straightaway, we changed it to Receipt Bank because one of the first things we did and the thinking around that was in my business tweet I had been basically a business marketing director for a number of businesses and one of them was accounting business in the UK. So I had helped to build an accounting business in the UK. So I was very aware of the different workflows and the different problems that accounting firms were facing. And so I felt actually absolutely this, this business, this product much more interesting for an accounting practice than an SME, you know, to actually give them a workflow they can deploy to all their clients. And obviously, this is 2010. There’s a huge amount of nervousness then about security in the cloud, etc. And the Receipt Farm is this sort of irreverent brand, you know, like that literally, the envelopes are covered. silhouettes of farm animals and stuff like that. And our thinking was, well, that’s not you know, that. This isn’t the time for an irreverent brand action and the word bank, we felt was such an easy, simple way to convey security. We didn’t do a big rebranding exercise, you know, we got rid of the animals. We kept the font, we kept the colors, we kept everything. We just switched the word farm to bank to try and reassure our our initial users and clients that you know, we’re taking security seriously.

Heather

Absolutely. I hope you’ve got one of those old envelopes framed.

Michael

It’s a good question. I don’t have an envelope but my sister when I left, gave his very, very lovely gift. As you can imagine, sort of over the years there’s different sort of Receipt Bank and T shirts from different events. And she gave me she’d sort of kept a series of thoughts on the different colors and stuff like that so many people will know Dext today as the orange. I picked the orange I didn’t know about 2012 2013 2014 was a bit later. So we’ve sort of got the colors before the orange and things like that and sort of the evolution in that. So that’s, that’s one of the things I need to get framed as putting those T shirts up.

Heather

Yeah, absolutely. It’s trying to think of nice ways to frame them and showcase them.

How did you meet Alexis Prenn?

Michael

Alexis and I had worked together a previous business. And I as I say it, my role had been basically a fractional marketing director. And Alexis, I’d been working in that business as a sales director. So we already sort of work together probably for a couple of years. And we we’d sort of fell Oh, we actually make quite a powerful team here. And so we’d already sort of had an agreement. Let’s look around for an opportunity to work together. And hence when receipt farm said they’re closing down and I wrote back saying I’d like to buy it. You know, my next call was to Alexis saying oh, I think I found our opportunity. Let’s do this.

Heather

Fantastic. So I have a photo of our first meeting together, which is Sydney XeroCon come August 2014. And I think in those early days, Receipt Bank, won Xero add-on off the year, four times between 2012 and 2015. So that was the Xero add on of the year.

How important has been the Xero partnership for Receipt Bank?

Michael

Huge, obviously. Xero, made an incredible investment in their API team. Right from the beginning. So when we integrated with Xero in 2010 2011. The what you could do with connecting the two software I think most people out there will at least recognize the phrase API but if you think if you think sort of the way you plug two bits of software’s together. And the key thing is not all API’s are equal, not at all. And so what Xero, what we could do with Xero was phenomenal because of the work they’ve done with the API. And that meant we could create this really powerful combination of, you know, everything from you know, let’s say we’re sending an invoice in, you know, being being able to, you know, does it go to, you know, is it approved? Is it not approved, being able to look up the existing contacts, so when we’re trying to put a name to something or we’re trying to put a name on an invoice or a receipt. You know, there’s a lot of people do their bookkeeping differently. So, you know, how do they previously record Bunnings in their Xero? You know, you know, is it just just the the word Bunnings? Is it Bunnings capitalised, non capitalised at Bunnings Sydney or you know, the fact we’re able to look that kind of stuff up and then match to that makes the bookkeeping a lot cleaner and not a lot neater a lot more correct. I’m using slightly sort of facile examples because I can’t think of the end of deeper examples, but Xero had done incredible work on their API. So we struggled with other integrations around the world. Where yes, you could send a receipt in or yes, you could send an invoice in, but you couldn’t create this really powerful experience. And of course, the other thing Xero had done was they had created things like Xero cost, and they have created things like roadshows. So it was an opportunity to be able to get in front of the Xero audience and show what we could do. So Rod and the team, you know, back then sort of Chris Reed in Australia, Gary in the UK. You know, they’d created this amazing platform for add ons as we were to sort of come in and, and say, no, no, we really can’t expand the Xero platform here. And create an even more powerful combined product. So yeah, Xero, just absolutely huge, huge, huge, huge.

Heather

Yeah, absolutely. And back in those days, as you said the API that they developed was so much more advanced than anyone around and it really it shifted some Goliath out there in the market. And I think sort of times have changed since then. But back in the day, it was. I remember just giving webinar after webinar explaining API’s to people because yeah, it was just unheard of and people just were like, magic. What is this magic?

After your time at Receipt Bank, are there any things that you’d have liked to get done differently?

Michael

I wish we’d done more international expansion. You know, we did a we did a good job in Australia. We did a good job in Canada, we do a good job and South Africa do a good job in France. But actually, there’s an opportunity to do more in sort of Germany, Netherlands, other countries like that. So it’s definitely missed opportunities there.

Heather

Other European countries.

Michael

Other European countries, and there was definitely we were a little too constrained by our own self image around you know, we were working on accounts payable and expenses, workflows. I wish we’d been a bit more expensive in. So, let me let me let me start in another place for that. So you know, if we look at what Xero was able to do for the industry, you know, and let’s just reduce Xero’s impact to one area, you know, it was an incredible productivity tool for the industry. You know, the bank feeds was amazing. The single Ledger was amazing. And the API was amazing. And so, Xero, was this huge productivity tool for the industry. And, you know, we see that and in fact, that enabled many firms to move away from from time based billing to give them the confidence of fixed fee, the increased productivity. And then Receipt Bank came in or Dext has now came in with what we did for accounts payable and expenses, and we were a significant productivity benefits. I do regret that I don’t think we did enough. Ignore that if we if we sort of think of the world in that way of actually the value we were able to assist the industry with was productivity and just literally looked at that that okay, fundamentally, we’re a productivity tool. Not an accounts payable tool. And we’d had more expensive conversations with our clients, our users about what are the workflows you need help with? How do we, you know, let’s say we’d set ourselves a goal of, you know, 5% productivity gain for our users every year, something like that. You know, I think I think that kind of game was feasible and probably still is feasible. But we didn’t quite look at the world in that way. So I, I, you know, I’m proud of of some of what we did, but there definitely were missed opportunities.

Heather

Thank you for sharing that. Look. I always say that an accounting someone who’s we’ve got online, the next step is a receipt scanning solution and that is going to make such a big difference for them. And I don’t even want them kind of thinking about anything else until they actually have that in place, and they’re comfortable with that. And it’s then they can start to kind of look at other things to adopt. So I remember years ago, you were everywhere. And then you gave a webinar. I’m not sure if you remember this, and it was on chess and AI and I was one of the first people I guess, I saw in the industry.

AI has been around for decades, but you were one of the first people in the industry to talk about it. Do you remember saying something like a person could not always win at chess, and AI cannot always win at chess, but a person working with AI could always win a game of chess?

Michael

I do. Centaurs. They’re known as centaurs. When a human plays with the computer.

Heather

So you obviously were having sort of deep thoughts about that because I remember we just used to watch all these how things were training push buttons, and then all of a sudden we had this chess webinar. We’re like, what’s happening?

Michael

Yeah, I can be a bit weird.

Heather

But the funny thing is what you talked about then that was years ago. That must have been seven years ago, maybe.

Michael

In 2015-16.

Heather

But in 2023 every webinar I’ve sat in has basically said that and there was that like massive gap of no one talking about it. So it was you obviously having these big thoughts about things and pushing it, pushing the industry forward, even if Julian Rosso and me listening coming.

Michael

I do try to start what excites me is about looking forward and looking about, you know, where the industry is going and what is possible. Yeah, that is that is absolutely the bit that interests me.

Heather

Yeah, absolutely. So for our listeners in 2021, overnight, Receipt Bank rebranded as Dext as people will know, possibly one of the biggest controversies in the industry. But then a few weeks later, there was a I’m paraphrasing a multimillion pound share buyout from the private equity group, HG capital. And so I guess that sort of you were there and then you sort of moved on maybe how to rest and then after sort of years of not being heavily involved in the accounting ecosystem, you’ve come back as the founder and CEO of Translucent, solving multi entity problems for businesses around the world.

Michael

That’s a very good summary.

Heather

How did your time at Receipt Bank lead you to launching Translucent?

Michael

Sure. Yeah, absolutely. So we mentioned earlier sort of Receipt Bank sort of expanded quite a few countries around the world. And our accounting setup at Translucent was, I think we had a QBO for France, and we had Xero’s for our other entities around the world. So I really must check on the exact number but we are something like six or eight entities so we’re running these multiple Xero files. And it’s a real problem. That’s a real problem and it’s no disrespect to Xero. You know, Xero is not designed to be a multi entity accounting system. But it’s a sign of Xero success that actually a lot of businesses grew up on it. And it’s super powerful. They really like what it does. And so when they add a second entity, a third entity, a fourth entity, they add you know, other Xero files, and the they’re then left with a series of workflows that don’t work because of course, two Xeros can’t talk to each other or two Xeros can’t consolidate. And of course, there’s other issues as Xero goes up, you know, it’s data model isn’t designed for this. It’s permission model isn’t designed for this. You know, it’s there’s a whole lot of different. There’s a whole lot of different issues that happen. And we saw this firsthand, that Receipt Bank, so we were, we had a good couple of years where our CFO was like I think we need to move to NetSuite. And the appetite in the business was well that’s a huge migration. That’s a big project there really isn’t much upside. So we spent a couple of years hacking around, you know, how can we do things to avoid this, this migration? And at the same time, I was out there speaking to a lot of other entrepreneurs, and they were saying the same thing. You know, so I was aware there was quite a community of people have, you know, I’m running multi entity Xero. And, you know, fundamentally, I’m happy with Xero for all my sort of single entity processes, whether it be payroll, whether it be year end well a bit, but the multi entity bits of problem. And so I’d recognise them, there’s a really interesting business, then. I, frankly, tried to give the idea away quite a few times. So a few entrepreneurs came up to me in the intervening years, it’s not all my clinic, good ideas, and I was like, Oh, if you want a huge business, you know, you know, build build multi entity Xero. But as these things you can’t really sort of give them away. People have got sort of feel it themselves. And then what happened in early 2022 Was I had made a number of angel investments. And one of the companies I’ve made an angel investment into, they phoned me up and he’s like my call a whole lot of our clients have this problem. And the problem he went on to describe was multi entity. And there’s something about hearing someone else describe it back to me. Someone else used their own language, completely unprompted. Made me think, oh, you know what, I am going to go and do this. And it does come back to I’ve got some pretty, pretty strong views about what the industry is going to look like in 2030. And what technology for accounting and bookkeeping is going to look like in 2030. And I think multi-entity is is one of the places that is right now very behind. And so what we’ve launched Translucent to do is to be the One Stop Shop solution for multi entity. So we don’t think you can solve multi entity by tying together a significant number of apps. We don’t think that makes sense. So instead, we’re saying look we will build app after app after app within Translucent within one application within one UI. And each app represents a workflow so we’ve already built multi entity search where you can search all your entity all your transactions, all your journal lines in one place. You’ve obviously an incredible boom for this EP Clark’s managing 10 Plus entities. We’ve already built group reporting, and this month we’re launching both our intercompany and our live sheets app to work on the data in Google Sheets and Excel. And we’ll launch you’ll see what you’ll see from translations will launch about an app every quarter. So we’ll launch at four apps a year. Because we do believe we’re in a different software era than we have been in the past decade, which I’m happy to talk about. But that’s that’s what we’re doing.

Heather

So with what you’re saying there and I’ll come back to I’ll come back later on to what you’ve the actual apps that you’ve released. You’ve mentioned to me the concept of a compound startup and how you’re using this to build Translucent.

Could you explain to our audience what’s a compound startup?

Michael

So the way sort of people in Silicon Valley think about technology they often talk about bundling and unbundling. From 2010, let’s use round numbers, from 2010 to 2020, we were in an unbundling era. So what that basically meant was these huge, powerful new technologies came along and they were mobile, and they were cloud and alongside cloud is broadband. And what that meant was a whole lot of workflows suddenly could be done differently. You know, we can go back to Receipt Bank, but we could go anywhere. We don’t need to stick to accounting, we can go obviously all across industry all around the world. These technologies meant you could do things in a different way. Now whether that was hailing a taxi with an Uber, whether that was getting a receipt in your accounting package with Receipt Bank. These technologies are fundamentally different and because they were such a huge change. The change was so vast and so all encompassing and impacting everything. It meant that 1000s and 1000s of new companies were born. Because of course, what each of these entrepreneurs or each of these founders was looking at, they were looking at a workflow they were familiar with and saying, oh well mobile changes that in this way. Or cloud changes that in this way. And there was the potential for so much change. It meant that companies typically were only focused like Receipt Bank on if not just one workflow, a very narrow range of workflows. So you had this unbundling phase where a huge explosion of new companies were formed. And I think every accountant and listener to your podcast will be familiar with this. Whether from walking the floor at XeroCon or whether the phone ringing for them or whatever it might be so from 2010 2020 we went through this unbundling phase was an explosion of new companies. Now where we’re at in 2020 2030 is if we think of that, that change I like to think of it like sort of an earthquake. You know, the earthquake happened in 2010 and everyone responded. But what’s happened from sort of 2015 onwards and definitely from 2020 onwards is the pace of change has been much, much, much slower. And I think, again, everyone listening would recognise that, and it’s not that technology companies and software companies haven’t been adding new features, but just the pace of change has been much slower. I think everyone would recognise Oh, they’ve been there’s much less Whoa, moments. There’s much less sort of surprises, much more incremental adding of features. And that’s a sign that sort of the earthquake of the new technology is finished and it’s a sign that we’re now in a bundling phase. And what that means is, it actually makes much more sense for software to do a wide range of workflows, because instead of having a vendor for every workflow, and having obviously to set up definitions or set up permissions or set up billing or set up users or all these different things in each different package, it’s much easier to do it in one place. So what you’re seeing around the technology world right now, is these breakout companies or companies that are saying to users is look, we know the workflows you’ve got. But what we’ll know do is instead of just doing one thing, we’ll do them all in one place, so you don’t have to learn a new app. You don’t have to, you know, define your metrics again and again, you don’t have to set permissions again and again, whatever it may be, and the most prominent and forward company in this space, a company called rippling started with payroll data and people data in the US. And there’s some great podcasts and writings around rippling and compound startup. But we’re bringing that concept to accountancy and finance, finance data. So we think it’s there’s something really exciting for users to be able to say, Look, you don’t need all these apps so we can cut your cost of software. We can cut your cognitive load of software, without in any way cutting the quality of software. So that’s when that’s why I talked about we’re doing an apple quarter.

Heather

Awesome. Thank you so much for sharing that. And with that sort of nice foundation and understanding there. Let’s move to talk about some of the apps that you’ve released through Translucent. So the first one is apt search and look, I’ll use my explain it to me like a five year old explanation for my audience in that you you plug in your Xero files or your QuickBooks files or your other files. And it literally seems to for me break down the data into Lego blocks and they’re all kind of sitting there. It takes it doesn’t happen instantly. It takes a bit of while to go through and do that. But you then jump into Translucent and you can just search for anything and it’s for me it’s phenomenally fast. To come back, do the search find things and you click on them. And you drill through and you drill through to get to whatever file is the Xero file of the QuickBooks file. So that search functionality I never in a million years dreamed you would be able to have. It is so much superior to the search functionality found within Xero and you’re offering it for free. It’s phenomenal.

Michael

Yeah, no, it is. So one way to think of Translucent is a bit like a data warehouse. So we’re trying to give our users a single source of truth. We do break down the walls. They might be using five Xeros or 50 Xeros. It doesn’t it doesn’t matter. We’re breaking all the walls between them down. So they’ve got one set of data, one warehouse of data. And so search is a very easy first app for us to do or say okay, you now got everything in one place. So whether you want to look at, you know, I’m gonna use trait examples again, if you want to look at all your Starbucks costs, you know, in across all your entities in one place you can and if you want to look at you know your total revenue across all your entities for one week or you know, one month in one place you can and if you want to find out which entity that invoice that needs to be paid today where that where you know where that invoice is gone. It will it will show you and allow you to click back through to Xero. And you’re right when you first set up Translucent with your Xero files. It takes it takes either some minutes or some hours to sync the data the first time but thereafter it’s live and an instant.

Heather

Absolutely. Sometimes, people are so used to magic these days. They think it happens instantly. So I always like to to put that reality in there. But yeah, look, it’s a phenomenal tool and it is free and I would encourage anyone who’s out there who’s dealing with any sort of multi entity scenario to try it out. So moving on from that one. You have the group reporting which consolidates your reports and it says it’s designed for up to up some reading from your website up to 200 entities that sort of Translucent is sort of pitching itself out.

Michael

So one of the things we’ve noticed with group reporting is obviously it’s quite a lot of tools have done consolidation and group reporting for quite a few years in the ecosystem. And we felt quite a lot of them were more tailored to sort of smaller number of entities, 234 entities. So we’ve deliberately looked to how solutions frankly like NetSuite have solved this. So we’ve got that greater ability to to deal with larger numbers. Frankly, we can actually deal with more than 200 but 200 just you know, there’s very, very few people but more than 200 Xero files and, and again, the way we’re doing this behind the scenes allows for some superpowers. So for example, we because we’ve already synced all the data and Translucent we can do things like drill downs. So when you’re looking at a consolidated report and Translucent let’s say that’s last month p&l You can click on any total and then see the drill down transactions that make that up. And in the next few weeks not only we’ll be able to see the transactions you’ll then be able to click through to the actual Xero file, so the actual transaction in the appropriate Xero file so you’ll be able to go all the way from, you know, that’s a you know, you’re looking at last month’s sales or you know, you’re looking at last month’s cogs, you know, click on a thing, look at the list of transactions want to click on a particular transaction go all the way back to Xero. So, you know, we’re really we’re really proud of some of the sort of technology platform we’ve built there and what we can do with it.

Heather

Yeah, no, it’s phenomenal. And so you look it’s phenomenal. I don’t think people even thought that this was actually going to be possible but what you’ve built here. Then app three is live sheets and accountants love their sheets. So this syncs up to Google sheets into Excel. And accountants love, love being able to get their data into sheets, so I’m sure that will be popular one as well. And then app four, which is coming out…maybe for Christmas?

Michael

First users will be using it for Christmas.

Heather

Which is the intercompany one, which I would call it intercompany loans. I think you refer to it as a treasury function. Am I correct?

Michael

No, no. Treasury is the next so there’s a bit closer to the next ones coming bank consolidation, so intercompany is just the ability, whether you’re doing recharges or whatever, it’s the ability it’s the first time we’re riding back to Xero. It’s the ability in one place to set up you know, intercompany, transactions, recharges, etc. And again, we’ve got some pretty exciting roadmap for what’s gonna be possible there. So yeah, so we’re excited excited about that app four.

Can you share anything about what’s coming? If people want to bring up any suggestions, what should they do?

Michael

Sure. So the next app we’ve made public is going to be bank consolidation. And bank consolidation isn’t Treasury but it’s sort of sort of proto treasury. So what it’s doing is it’s looking at all your different bank accounts across all your entities, and putting them in one place. So on one screen, you can see, you know, obviously your total cash position, but also your cash position by currency, your cash position by entity. You can see your cash position alongside your AP and your AR, you know, and it just gives you that ability to you know, to do basic sort of cash management on a multi entity way, in a way it’s just, again, not possible today, and we’re not going into payments yet. We’re not going to Treasury yet or anything like that. And I say yeah, I don’t know if we ever will. But it’s it’s, you know what we’re trying to solve. It’s just I’d say each multi entity workflow one by one. And this is we know people right now are having to rummage around from system to system just to see their cash position. And so that’s what we’re aiming to solve in q1.

Heather

Yeah. And if people are interested in feeding back, what they see out there that they would like to solve, how can people reach out?

How should people who are interested in contributing do?

Michael

So yeah, just absolutely. You know, they can contact me sort of Michael Wood. That’s Michael at Translucent dot app, or any member of the team we’re always super interested to hear on what other problems people want solved. And I can’t emphasise enough how many apps we’re building. So right now we’ve got a long list of about 30 apps. We’re going to do we think we’re going to do for a year. If anything, I’d say that’s going to be at least for a year. That’s not a stretch goal for a year. And I see we’ve got a list of 30 that list will grow. And we’re very, very open to reprioritising that list.

Heather

That’s 6 year’s planning.

Michael

Exactly. Some apps are smaller, you know, some apps we can build in about three or four months. Some apps are bigger or takes a couple of years. And we’ve talked about Xero a lot. But also what we’re trying to do is we’re trying to connect up the world. So also in the team building of the apps. I’ve got a team connecting other systems. So just this week we finished our Penny Lane integration. So Penny Lane is the leading cloud solution in France. QuickBooks Online recently exited France. So Penny Lane is sort of the default cloud app in France.

Heather

It’s not a French name.

Michael

No, it’s Penny Lane. I must ask the CEO. I’m actually asked him where what why that one is called Penny Lane. But but then yet, we’ve just finished that integration. And we’re going to be doing integrations literally around the world. So I know there’s a lot of you know, I wouldn’t have guessed this. There’s actually a lot of demand for Australia to Germany. The main system in Germany is data hubs. And we’ve had a lot of requests for Xero to data is an interesting one. And so you get these interesting sort of trade corridors of a lot of business there and there. And so as well as building this suite of app solving multi entity there, we’re building our suite of integrations so that you know, no matter where your business is operating, or your clients are operating, we expect Translucent to be a platform that can bring the data together.

Heather

When I was 14, studying accounting, and it does sound like that you perhaps have got this far and haven’t studied accounting, so…

Michael

That is absolutely true.

Heather

So when I was 14, and started studying accounting, I was like, wow, serenity. I love the balance of it. And global. I can just work anywhere in the world.

Michael

You’ve done some cool things with that Heather as well.

Heather

I have, but I’ve just set that whole vision accounting is global. And then Xero, was the first solution that had for me that was accessible that had that global access. It actually had a global file in it. And and it sounds like you know, you’re again, pushing the envelope with this global conversation. And I know, I’ve just come back from the Singapore, Asia, business and finance Expo and I have Alex Falcon-Huerta from the UK and Paul Gardner from Hong Kong on the stage with us all talking about Translucent and all talking about how it’s solving their multi entity problems because they’re living the accounting dream of traveling and working globally and dealing with global businesses.

Michael

We’re really in the middle of a movement. A much more global world. Obviously, you know, there’s a lot of talk of, sort of protectionism right now, and that’s obviously true. In certain certain trade flows. But I think, again, all your listeners would recognise whether they’re doing some outsourcing or whether they’re, they have clients in different countries. There is so much so much globalisation going on. And it doesn’t make sense to have a different tool set by country, which is what a finance team or an accountancy practice has to live with today. And that’s very much a problem. We’ve got our sights set on.

Heather

If we haven’t stressed it enough, it does offer that multicurrency alignment as well, which I don’t think we said multi entity so many times. So it would be remiss of me not to mention that you’ve attracted some very well known characters and credentials to invest in Translucent. So of the people I know GoCardless One of the Jame’s from HubDoc, Guy Pearson from Ignition, Stewie McLeod from Karbon, I believe Kashflow, Libeo, a few others there and two Xero founders, two of the five Xero. That’s so impressive. I’d love to be a fly on a wall or in the Swiss ski chalet when you all come together to discuss.

You’ve attracted some well-known characters, and credentials, to invest in Translucent like ComplyAdvantage, GoCardless, HubDoc, Ignition, Jeeves, Karbon, KashFlow, Libeo, and even 2 Xero founders. How will you leverage that?

Michael

We have not yet. We’ve had just a year of building you know, we’re not we’ve not really started any sort of serious marketing or advertising yet that all happens next year. Because we’ve had a year to year more than a year of just building but those investments I’m really pleased that they all came about just because when I thought I’m gonna go and solve this problem, I phoned up people I know in the industry, it’s a what do you think is this? I think it’s a big problem, but it’s a bit of a funny problem. There’s no numbers around it. You know, there’s no there’s numbers anywhere saying oh, there’s this many multi entity businesses in Australia or there’s this many multi entity businesses on Xero. So it’s a bit of a funny space. And so I was I was phoning them up, say, you know this industry really, really well. I think there’s a big problem, but please tell me if I’m looking in the wrong place. And the conversations were just again against that, no, no, we think victims are really there’s a really big problem there. It’d be really interesting to solve. So that that’s how those competitions came about.

Heather

An exciting room of people and it gives a lot of authority and and kudos to you that they want to work with you and to the solution that you’re building. So, you’ve mentioned that you have a lot of opinions on the lot of strong views on the accounting, the future of the accounting and technology industry through 2030. So would we would you as we’re nearing the end of this podcast like to share some of those views?

Michael

Sure. So the best thing I think to do is it look at sort of what you know, where how do you maximise the value of the data? You know, so if we you know, that that is the journey that the industry is on. So, why, why did we all move to the cloud, we move to the clouds, because the data is more valuable in the cloud, and it’s cheaper to work on the data or let’s use term service, the data in the cloud. And again, that comes back to bank feeds, it goes back to API’s. So it’s cheaper to service, but it’s also more valuable. And that value was both in the ability for people to access it. It was the ability to manipulate it, and it was the ability with sort of API’s taking this out to you know, connect it to other things, whether it be FP&A solutions or you know, share it with other parts of the business, etc. So this SMB finance data is on a journey. It’s on a journey independently or independent of any of us, of moving to wherever the value is maximised. And so obviously, the cloud made sense and it’s, it’s a cliche to talk about AI. Of course AI is going to do is going to play a huge role. Again, it’s quite obvious to see, you know, most of the it’s both obvious to see what AI is going to do. And yet it’s very difficult to as a firm owner, or a CFO to do anything today, because there aren’t suitable robust solutions and places. The AI is a bit funny, I think as a CFO or running an accountancy practice because, you know, it obviously is the next step. But yeah, there’s no point in trying to take the step today. So So what’s going to happen is, is there’s going to be more and more uses to this data. And we’re seeing already the the example I gave to watch is, if you look at what’s happening in procurement in America, there’s two companies Vendor and Ram, that now publish quarterly indexes, sort of saying, you know, here’s what people are buying, here’s what people are paying. Here are interesting vendors. It’s a bit like, you know, it’s a bit like the top 40 of old you know, it’s like you know, is Madonna going up is Michael Jackson going down? You know, I’m showing my age there. But it’s, it’s a bit like that for vendors, you know, rather than waiting for marketing, so someone’s comments like, well, actually, who’s buying what what are they paying? So we’re gonna move into this much, much more transparent world next have data. So everyone was very fixated in the move from desktop to cloud around security and privacy, then that completely made sense. There isn’t going to be a sacrifice and security of privacy, but that is going to be more transparency. So there is going to be ways that people are going to share data. And these procurement benchmarks are a wonderful example of the future is already here. It’s just not evenly distributed. So I don’t want to say too much more than that. At this stage. I want to sort of, you know, I want to sort of build on what we’re building and then be able to show people some things will be pretty exciting. But, yeah, I think the data is going to be increasingly valuable, which means for firms and finance departments that want to keep working with technology vendors, they’re going to become even more important. But it does require surfing that technology wave because the data is going to become more and more valuable, and that’s what we’re going to see.

Heather

Thank you so much, Michael for spending an hour talking with me. This is an interview I’ve been wanting to do for many, many years. So very excited to to finally connect and be able to do this with you. I want to encourage our listeners if they’re interested in Michael’s product to visit Translucent.io.

Is there anything else you’d like to share with the audience?

Michael

I think the only thing I would I would like to say is is a thank you. You know, obviously I’ve been part of this community now since sort of 2000. Let’s say 2011. But you know, and and Heather, obviously, you personally have been a sort of huge part of that community. I’d like to say thank you to you, and what you’ve done for the community, but also, let’s say thank you just the community sort of more widely like as you said, you said earlier in this podcast of you know, well if anyone wants to reach out and shape the product, I know I’ll get emails, you know, we are there is this community where people sort of want to grab the steering wheel and sort of steal as possible and people are are thoughtful with their time and I hope it Receipt Bank we were and I hope it translates that we will be sort of suitably receptive and rewarding for that. So you know, it just I’ve always been welcomed in this community and just just want to say so thank you to those that are part of it.

Heather

Absolutely. It’s been such a joy having you on the podcast. I’m sure we’ll get you back again, because there’s so many things in your world. Thank you so much, Michael.

Michael

Thank you.