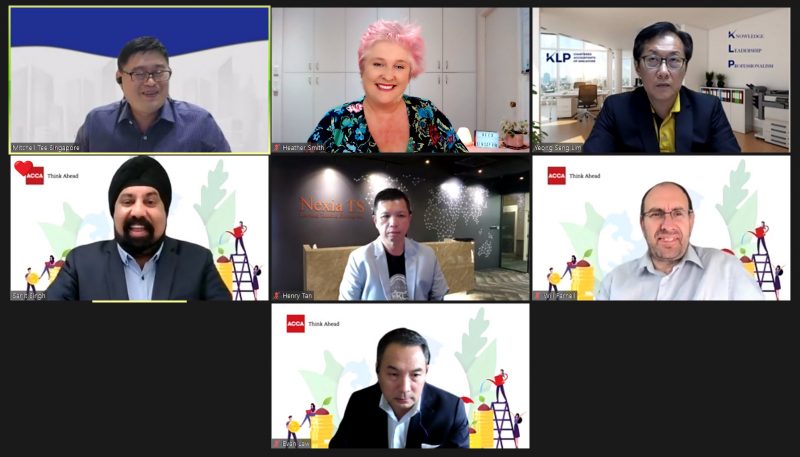

I recently was wondering about the difference between budgets and forecasts and I asked this question in numerous online areas. I got a wide range of responses, and below I have posted a response from Moosa Fense. Moosa is a member of ACCA and Strategic Innovation Director at INNOVATIVE HOLDINGS.

Heather, unfortunately this is an area that many businesses get confused and lack expertise in. Technically a forecast predicts what the results of a business will be if the status quo remains unchanged i.e. operations etc continue as is (no change). A budget in contrast is when a business sets targets (wishlist) and the changes that need to be made specifically in operations are identified and built into the budget as drivers to achieve the targets. A budget in essence is a roadmap to improved performance for which change is usually a requirement. However, most business fail to make this link with operations and merely work with percentage based increases assuming they will achieve better results (without changing anything that they do) and inevitably their actual performance ends up very far from their budget (I have seen budgets off by 10s of millions of dollars). The key is that a budget should not be just a wish list but rather a real plan of action to improve results. So no, the two words are not interchangeable even though some accountants use them as such it is in fact wrong.

With regards to your second part of the question, in best practice normally both budgets and forecasts should be complete and include all P&L elements. In practice though companies tend to focus on key accounts. Depreciation and amortisation would be driven by capital budget element. Whilst most companies only do P&L budgets it is best to also do a budget Balance Sheet and also a budget Cash Flow. This includes drivers such as working capital cycles, Fixed Asset and Intangibles movements as applicable, tax calculations. All three budget models should be interlinked and balanced much like a GL.

If businesses gave budgets the appropriate level of respect and effort then we would not be seeing the high level of company failures that we see now. Fail to plan, then plan to fail…..and a poor plan has the same outcome. Whether it is a large or small business the level of importance is the same…..crucial.